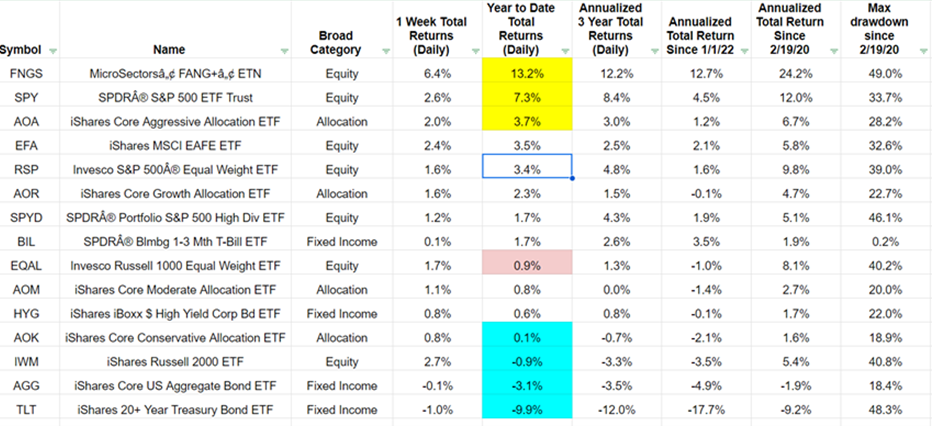

It is getting to that point in the year where “year to date” performance starts to have some meaning and trend. Here’s what I see in the data, writes Robert Isbitts, editor of ETFYourself.com.

Yellow section: The S&P 500 ETF Trust (SPY) is up more than 7% in four months, and the MicroSectors FANG+ ETN (FNGS) has produced above-average returns, continuing the move that started last Halloween. But markets are getting volatile and earnings season is not over. So, this will likely be a moving target the next few weeks. This is why I despise earnings season.

Blue section: As has been the case more often than not, bonds are lacking and so are small caps. The higher interest rates go (and they do look poised to go higher), the worse this could get. “Conservative” investors – as tracked by the iShares Core Conservative Allocation ETF (AOK) are NOT A-OK and have not been for years. This has caused many to “reach” for risk assets (stocks and other stuff), which works well...until it doesn’t.

Pink section: The Invesco Russell 1000 Equal Weight ETF (EQAL) shows that the average stock of the top 1,000 is up less than 1% this year, and has a 3-year annualized return of 1.3%. Bull market? Depends who you ask.

Blue boxed data point: The Invesco S&P 500 Equal Weight ETF (RSP) is up 3.4% this year, and that’s solid. However, when you consider that it is less than half the return of SPY, it tells us loud and clear that this is not yet a sustainable “widening” of the market beyond a small number of big stocks.