Owning is good, but I don’t want to own a perception or illusion. What we practice and preach is owning shares of high-quality companies that we have torn apart and looked at under the hood to know what is real, with no interest in fiction here. Johnson & Johnson (JNJ) is one that’s looking more attractive, notes Kelley Wright, editor of IQ Trends.

Speculating, when successful, is exhilarating. Unfortunately, the long-term track record for building wealth from speculation isn’t the greatest. We aren’t actors and don’t play characters in a movie, but we do have a real-world approach that works if you have the patience and discipline to stick with it.

That brings me to JNJ. It is the largest healthcare products firm in the world by sales, spanning pharmaceuticals, medical devices, and consumer products. The Innovative Medicine segment develops and markets a wide range of synthetic and biologic drugs. JNJ’s most important therapeutic areas in Pharma are Immunology drugs that treat autoimmune diseases like Crohn’s Disease, psoriasis, and arthritis; Oncology drugs that treat tumors and other forms of cancer; Neuroscience drugs for disorders like depression or schizophrenia; and Infectious Disease drugs for Covid-19 or HIV.

Pharmaceutical products are complex and difficult to develop, often consuming several years and billions of investment dollars only to be found ineffective in late-stage human trials or failing to pass regulatory approval hurdles. When this occurs, JNJ can take large write-downs on in-process R&D assets.

Despite these failure risks, JNJ spends considerably on R&D ($15.1B in 2023, $14.6B in 2022), and most of its M&A spending goes toward acquiring companies with promising pipeline drugs. Frequent reinvestment in new drugs is needed to keep the pipeline full of potentially marketable drugs that can eventually replace existing drugs, which over time lose market share to competing treatments or become obsolete due to new ones.

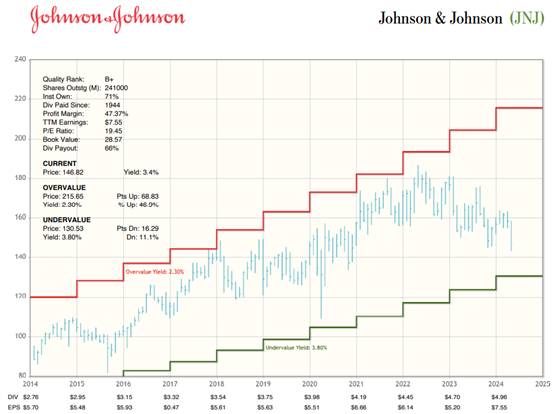

JNJ's Economic Book Value is $125.05 per share, and the ROIC, FCFY, and PVR are 13%, 11%, and 1.2 respectively.

Recommended Action: Buy JNJ when it gets to my undervalued yield zone.