Jobs data is out this week. Economists and the Fed will be looking to see if the labor market is slowing, given the longer period of elevated interest rates. The earnings calendar is light, though there are some late stragglers, advises John Eade, president of Argus Research.

The Dow Jones Industrial Average ended last week lower by 1%, the S&P 500 was down 0.5%, and the Nasdaq lost 1.1%. For the year, the DJIA is higher by 3%, while the S&P and the Nasdaq have both gained 11%.

On the economic calendar, the big day is Friday, with the release of jobs data. For April, nonfarm payrolls came in at 175,000. We forecast a slight decline to 168,000 for May. The unemployment rate printed at 3.9% in April. We expect no change in May.

In other economic news, on Wednesday ADP employment and the US trade deficit will be reported. On the earnings calendar, on Wednesday, Lululemon, Dollar Tree, Campbell Soup, and Five Below report; and on Thursday, JM Smucker and NIO Inc.

As of last Friday, 98% of the S&P 500 companies had reported for 1Q24. Earnings were 8% higher than in the same quarter last year, which is better than what was expected before the reporting season began. Communication Services, up 43%, and Consumer Discretionary, up 27%, have performed the best. Healthcare and Energy, both down 24%, have performed the worst.

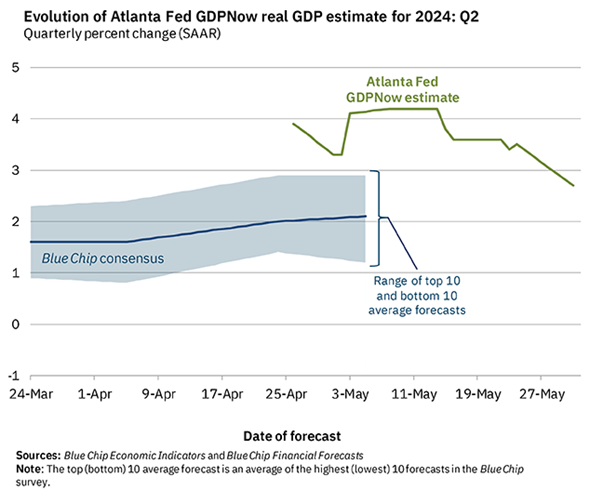

Last week, mortgage rates moved back over the 7% mark, to 7.03% for the average 30-year fixed-rate mortgage. Gas prices were unchanged at $3.58 per gallon for the average price of regular gas. The Atlanta Fed GDPNow indicator is now forecasting for 2Q and calls for expansion of 2.7%. The Cleveland Fed CPINow indicator for April forecasts 3.36%.

Looking ahead, the next Fed rate decision comes next week, on June 12. Pretty much no one expects a rate change at that meeting. After that, the next meeting is at the end of July, with odds at 16% for a rate cut. Then in mid-September, the odds pop up to 55% for a cut.

Like the Fed, we are data sensitive. At this time, we still expect two rate cuts in 2024, one in September and one in December. We also forecast two cuts in 2025, both in the first half of the year. All four cuts are forecast to be by 25 basis points.