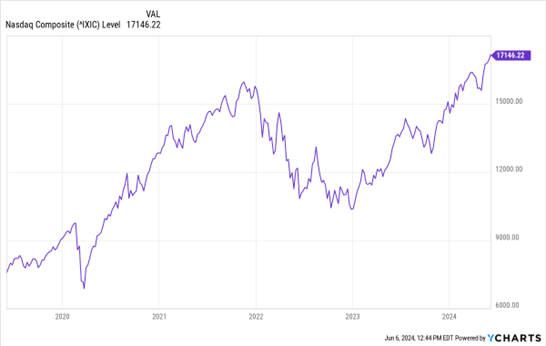

The Nasdaq Composite Index exceeded 17,000 for the first time on May 28. But it has been a long climb for the index. And while the tech-heavy Nasdaq has been good in general for investors, timing does matter, notes Bob Carlson, editor of Retirement Watch.

After its inception in 1971, the Nasdaq didn’t break 1,000 until July 1995. It took another 1,095 trading days for it to break 2,000. By then, the tech stock bubble was beginning. It took only 475 days to cross 3,000, 56 days to break 4,000, and another 71 days to break 5,000.

The popping of the tech stock bubble was traumatic for the index and those invested in it. After falling significantly below 5,000 during the bear market, it didn’t close above 5,000 again until 2015. It wasn’t until April 2017 (6,256 days after breaking 5,000 the first time) that the Nasdaq breached 6,000, according to Bespoke Premium.

Data by YCharts

After that, the index soared through new 1,000-point levels fairly regularly, though with a lot of volatility. For example, it bounced above and below the 8,000 level 37 times before apparently putting that benchmark in the rearview mirror, according to Bespoke’s data.

The index was especially strong after the pandemic bear market. It broke 10,000 for the first time in June 2020 and eclipsed 17,000 less than four years later.

But the surge slowed down after the Fed began tightening monetary policy. The index exceeded 16,000 in November 2021 and didn’t close above 17,000 for 921 trading days. That’s the fourth-longest period between 1,000-point thresholds for the Nasdaq.

As for timing, keep this in mind: Buying as the tech stock bubble inflated and not selling early in the bear market was expensive. It took about 15 years for the index to regain the bear market losses.

Also, the 17,000 level was only a 6.3% gain from the 16,000 threshold. To look at it another way, since the November 2021 high, the index has returned only 2.3% annualized.