Last week, the federal government released the first-quarter gross output (GO) data, with mixed results. Meanwhile, natural gas distributor The Williams Companies Inc. (WMB) is doing great, up 25% year to date, highlights Mark Skousen, editor of Forecasts & Strategies.

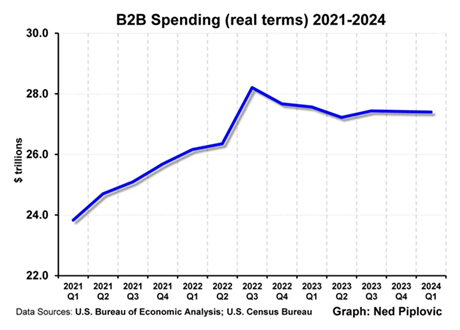

Real GO rose 2.5% faster than gross domestic product (GDP), thanks largely to robust consumer spending. But business (B2B) spending continues to lag and, in fact, declined slightly for the second quarter in a row.

(Editor’s Note: Mark Skousen is speaking at the 2024 MoneyShow/TradersEXPO Orlando, which runs Oct. 17-19. Click HERE to register)

It suggests stagflation into 2024. But I’m still optimistic about the economy for the rest of the 2020s, especially after the Supreme Court ruled twice last week against government agencies such as the Environment Protection Agency (EPA) — the Chevron case — and the Securities & Exchange Commission (SEC).

The Supreme Court ruled that these bureaucracies must follow Congressional guidance to limit their powers and can’t rely on their own courts to defend their often draconian regulations, and excessive fees and fines.

As for WMB, UBS just released a report suggesting “strong long-term prospects” for the company. Earnings are expected to grow nearly 14% this year, and even more thereafter, since the federal government approved natural gas deliveries by Transco across a 10,000-mile network from South Texas to New York.

As one of the largest domestic transporters of natural gas by volume, WMB owns Transco. This interconnection will likely increase the volume of natural gas transported through Transco, boosting Williams’ revenues and indirectly benefiting its stock price.

Recommended Action: Buy WMB.