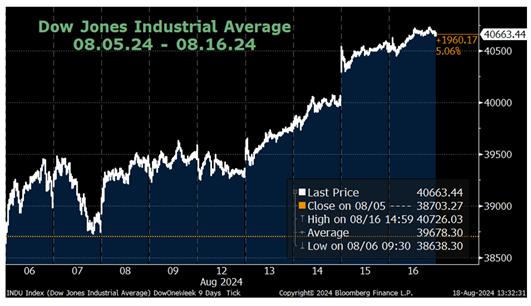

We concede that several trading days does not a trend make and we understand that equities could have continued going south. But it is fascinating that stocks just turned in their best week of the year, with the Dow rebounding more than 1,100 points, bringing the nine-day bounce to nearly 2,000 points. KeyCorp. (KEY) is a stock we like here, highlights John Buckingham, editor of The Prudent Speculator.

The move came right after respected market expert Jeremy Siegel, the author of Stocks for the Long Run, was seemingly losing his head with a call for a 75-basis-point emergency cut in the Fed Funds rate...and the financial press was busy warning that volatility was spooking investors, even when our favorite Main Street sentiment gauge was arguing otherwise.

Now, we respect that neither Mr. Buffett in 2009 nor Professor Siegel this time around was suggesting that anyone dump their stocks…if one bothered to listen to all of what they had to say. But the sensationalistic headlines around their interviews likely caused more than a few folks to head for the exits, adding credence to the number crunching that has been done through the years by DALBAR that shows the only problem with market timing is getting the timing right!

As for KEY, shares jumped 12% in price last week. The regional bank said it entered into an agreement to sell newly issued shares to the Bank of Nova Scotia for a price of $17.17 each, for aggregate consideration of approximately $2.8 billion. The consideration pencils out to approximately 14.9% of all shares outstanding following the consummation of the transaction.

The issue price was an 18% premium to where shares closed trading in the prior week but wasn’t far from where the stock had been just a few weeks back. Scotia Bank will purchase 4.9% at the end of August and pick up the remaining stake after regulatory approval.

KEY CEO Chris Gorman said the decision to enter such a partnership wasn’t related to capital needs. Instead, he suggested that KEY was “approached by Scotiabank, a significant financial institution that wanted to make a strategic minority investment in Key on attractive terms both with respect to premium paid and a governance framework that allows our company to maintain strategic flexibility.”

Mr. Gorman added, “This investment presented us with a unique opportunity to realize incremental value for our shareholders by accelerating our capital and earnings momentum, improving tangible book value per share by over 10% and strengthening our overall strategic position in the marketplace. The investment also creates greater capacity for growth by facilitating additional investments in targeted scale across our franchise.”

At the very least, we are encouraged that a major buyer found KEY shares attractive. Additionally, the capital ought to bolster the bank’s balance sheet and add earnings power, whether through a greater capacity to lend or to take advantage of investment banking business regardless of whether a strategic fit exists with Scotia. We have lifted our target price for KEY to $19.

Recommended Action: Buy KEY.