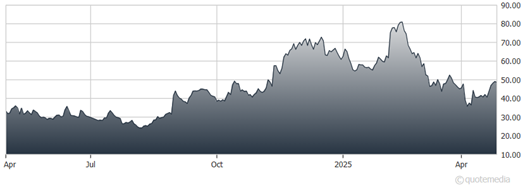

It’s still too early to get excited that the worst is now officially behind us for the averages. That being said, if you’re wanting to put money to work sooner rather than later, one stock that you are most encouraged to look at first is Affirm Holdings Inc. (AFRM), suggests Nate Pile, editor of Nate’s Notes.

All of the major indices I use to gauge the health of the overall market have bounced nicely off the lows they set in response to “Liberation Day.” A few of them are even starting to get close to being back where they were prior to that event.

Not only do we have the possibility of some initial trade agreements being reached that will give us at least a small glimpse of what the Trump Administration is actually hoping to achieve on the tariff front, but we are also heading into the thick of earnings season. Provided we end up getting some decent news on both fronts, it is quite possible that my “Eyebrow Levels” will all be back to flashing “bull market” soon.

Still, as of last Friday, the Model Portfolio was sitting on a 27.9% cash position, and the Aggressive Portfolio (which has historically spent most of its time “on margin”) is also sitting on a small 1.3% cash position. I am sleeping comfortably at night with both those numbers.

Meanwhile, Affirm offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others.

Recommended Action: Buy AFRM.