Applied Digital Corp. (APLD) is a rapidly expanding data center operator that is partnered with AI leaders. Data centers are the gold mines of the 21st century...places where discoveries happen and fortunes are made, advises Adam Johnson, editor of Bullseye Brief.

Estimates peg the number of data centers globally at 5,000, with another 1,000 expected this year (ABI Research). But one tiny Dallas-based operator has captured the market’s attention. It operates just three locations...but is quadrupling capacity and has partnered with two of the industry’s best-known enablers: CoreWeave Inc. (CRWV) and Nvidia Corp. (NVDA).

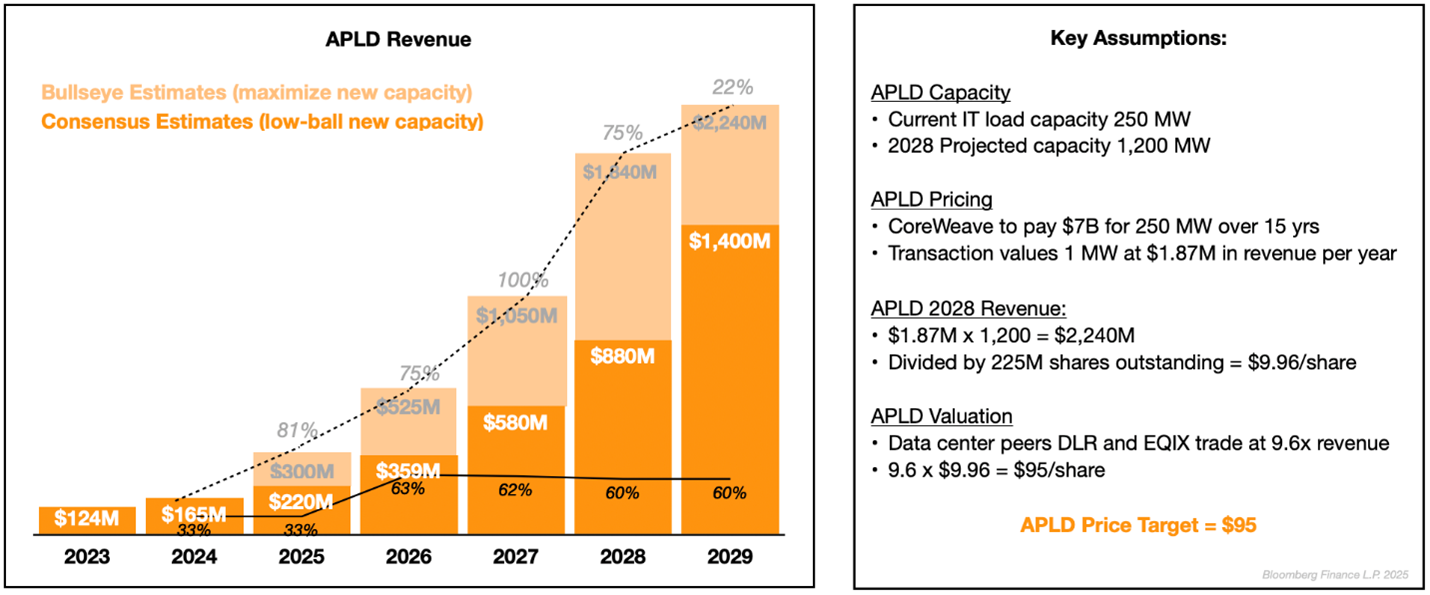

APLD’s three sites have a combined 250 MW of IT load capacity, and that’s expected to rise to 1,200 MW over the next three-four years. The company’s rapid expansion will drive a twentyfold increase in revenue and enable profitability by mid-2026.

Demand for AI services is growing so quickly that ChatGPT took only two months to go from zero to 100M users. By contrast, Twitter needed five years to accomplish the same feat. Netflix Inc. (NFLX) needed ten! Similarly, a ChatGPT search query requires 2.9 watt-hours of energy, nearly ten times the amount consumed by a Google search.

Applied helps solve this energy crunch by making AI available as a service, on demand. You only pay for what you need, and Applied rents your bandwidth to others when you’re not using it. Plus, by locating its facilities in places like South Dakota, where temperatures are lower and energy is plentiful, cooling and powering are more efficient.

I have a $95 target on the stock, which reflects a current peer revenue multiple applied to 2029 revenue estimates (9.6 x $9.96 = $95). Several assumptions drive this analysis: 1. APLD’s IT load capacity rises from 250 MW this year to 1,200 MW in 2029 on planned expansions at its three locations 2. CoreWeave’s recently announced lease contract with APLD pays APLD $7B over 15 years for 250 MW of capacity annually, valuing 1 MW per year at $1.87M, or $9.96 per share.