Bubble talk is heating up again. Google tells me that searches for “stock bubble” have reached the highest level in four years. Instead of getting caught up in nonsense, let’s establish a few universal truths for speculating about – and investing in – a so-called market bubble, writes Callie Cox, chief market strategist at Ritholtz Wealth Management.

Stock market bubbles are so misunderstood. They come out of nowhere, blow bigger than anybody expects, and pop when the biggest haters come around to them. So, let’s talk about my seven bubble rules.

Rule #1: You do not say the word “bubble.” The stock market trades away from earnings and economic data all the time. Bubbles can only be spotted in hindsight because you know how the story ends. Nobody knows how much is too much. That’s why you should just strike “bubble” from your investing vocabulary. Don’t even go there.

Rule #2: You do not say the word “bubble.” Yes, I’m invoking Fight Club here. From here on out, we will only refer to it as the b-word.

Rule #3: Prices will rise higher than you think. B-words tend to form when stock prices shoot higher. But that doesn’t mean a b-word is forming just because stock prices shoot higher.

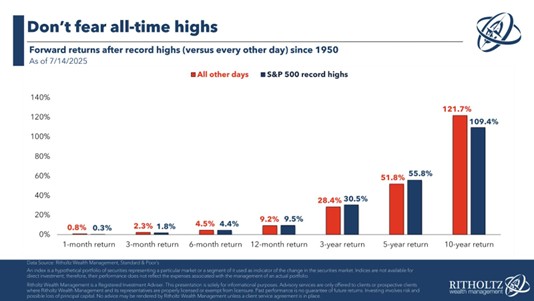

Also, record highs rarely mean stocks have reached a dangerous top and are ripe for a crash. Since 1950, 80% of S&P 500 record highs have led to at least one more record high in the following week. And in the past, if you’ve bought stocks at record highs, you’ve enjoyed respectable returns over several timeframes.

Rule #4: Prices do not define value. You can’t judge a market on price alone. Doing so ignores a lot of crucial context as to why prices are so high.

Even PE ratios alone can’t tell you much about the stock market’s future. The tech-heavy Nasdaq’s PE ratio is near a five-year high. But you could argue that’s a fair value if Artificial Intelligence (AI) promises to turbocharge profits and tariffs aren’t as scary as some fear.

Rule #5: Prices do not define the idea. This is where b-word talk can get heady. Often, market excess aligns with a new idea or innovation that captures the hearts and minds of the world. Today, that idea is AI. The promise of AI is one of the reasons the S&P 500 has notched two straight years of 20% gains and has managed to stay afloat in a year of chaos.

Rule #6: Keep your balance. Let’s say the haters are right and the market is indeed in a b-word, soon to pop in a grand fashion. Even then, you don’t need to be afraid. You have agency here. You can hedge around your stock holdings through bonds and cash to make sure you’re prepared if prices fall.

Rule #7: Remember your humanity. The most important rule. Investing is never easy. It’s also natural for us to anchor on past experiences. No wonder your mind is rewinding to the 2000s malaise or the early meme stock days. You don’t have to participate in the b-word talk. In fact, I’m giving you a pass today to tune it all out.