Established in 1904 and headquartered in Tupelo, Mississippi, Renasant Corp. (RNST) operates as a bank holding company for Renasant Bank. The company offers an array of financial services, including wealth management, fiduciary, and insurance services to both retail and commercial customers, highlights Kelley Wright, editor of IQ Trends.

The Community Banks segment provides a wide range of services such as checking and savings accounts, business and personal loans, asset-based lending, and leasing equipment. Renasant Bank extends its operations across the Southeast, with lending and asset-based services available nationwide. It owns subsidiaries like Park Place Capital Corp. and Continental Republic Capital (Republic Business Credit), which further expand its reach in financial services.

(Editor’s Note: Kelley is speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

As of Dec. 31, 2024, the company maintained 180 banking, lending, and mortgage offices throughout the Southeast, alongside four stand-alone offices under Republic Business Credit in California, Illinois, Louisiana, and Texas. Renasant’s wealth management operations offer services like trust account administration and investment services.

The company’s strategic focus involves maintaining a robust local presence through its community bank model while centralizing key functions for efficiency and quality control. Renasant primarily competes with regional and national banks, savings and loan associations, credit unions, and finance companies in its service areas.

The ROIC, FCFY, and P/EBV are 7%, -2%, and 1.4 respectively. Economic Earnings = -$0.79 vs $3.21 reported. The EBV = $26.84 per share. Ten thousand dollars invested five years ago is worth approximately $16,604 now.

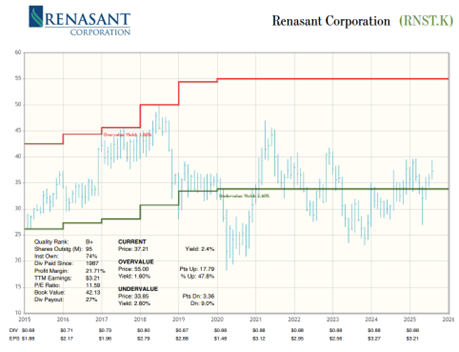

Recommended Action: Buy RNST.