We have much to contemplate this summer vacation…and much to celebrate as markets rally to new highs on a combination of clarity, resilience, and stimulus. Tariffs of 10%-15% are lower than feared – and probably a level everyone can live with. Meanwhile, Intapp, Inc. (INTA) just jumped 15% on a 17% earnings beat and 17% guidance increase, writes Adam Johnson, editor of Bullseye Brief.

Wobbly jobs data and a mild uptick in inflation have done nothing to dent earnings growth or forward guidance. A staggering $17 trillion of foreign investment since Inauguration, coupled with record Artificial Intelligence (AI) spending, amounts to the largest stimulus program in history. American Ingenuity is thriving.

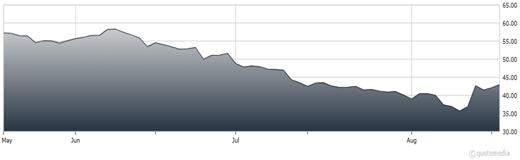

Intapp Inc. (INTA)

Indeed, we are entering a golden moment for investing in America because the economy is strengthening, earnings are rising, capex is accelerating, and Washington is cooperating. In addition, the Fed could begin to cut rates within weeks. Never in my career have I seen such a confluence of positive factors capable of driving our American Ingenuity portfolio appreciably higher.

I am fully invested and I think markets will move appreciably higher over the next several months. The trend will likely accelerate into 2026 as trade normalizes, supply chains re-shore, confidence rises, capital expenditure increases, and oil falls on peace in Europe. The path will not be linear. Even healthy markets typically correct 8%-10% two to three times per year. But the trend will be higher.

As for INTA, the company typically beats and raises. But this quarter was particularly well-received because many had expected a softer outlook for this leading provider of back-office software used by professionals (accountants, doctors, lawyers). Their success bodes well for the current business cycle. These firms are buying more software because they can afford to and they’re bullish on growth.

Recommended Action: Buy INTA.