Primerica Inc. (PRI) provides term life insurance to middle-income households in the US and Canada. On behalf of third parties, it also offers mutual funds, annuities, and other financial products. Primerica has demonstrated strong historical performance, with its earnings per share growing at a stellar compound annual rate of 15.6% over the past decade, writes Ben Reynolds, editor of Sure Passive Income.

As of June 30, PRI insured more than 5.5 million lives and had approximately three million client investment accounts. The company’s product offerings are sold via a network of 152,592 licensed sales representatives who are independent contractors.

On Aug. 6, PRI released its financial results for the second quarter ended June 30. The company’s total adjusted operating revenue increased by 7.4% year-over-year to $796 million during the quarter.

That was mostly driven by double-digit percentage growth in the Investment and Savings Products segment, with revenue of $298.3 million in the quarter. Term Life Insurance revenue increased 3%, while Corporation and Other Distributed Products revenue increased 5% for the quarter.

Adjusted EPS of $5.46 (after backing out one-time items) grew 10.3% over the year-ago period. Adjusted diluted EPS beat the analyst consensus during the quarter by $0.26.

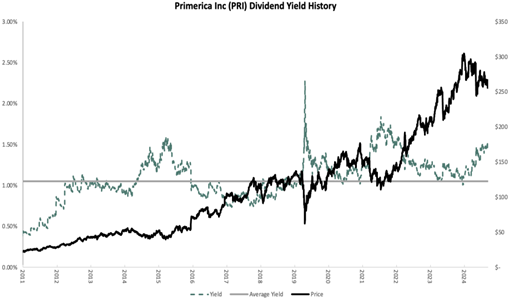

Meanwhile, we believe Primerica offers a solid degree of financial safety. That is anchored by a consistently low dividend payout ratio, which has averaged just 16% over the past five years. It now stands at 20% based on this year’s expected EPS of $21.21.

We expect Primerica to grow EPS at a rate of about 10% annually over the next five years. This growth will likely be driven by a mix of factors, including the continued expansion of its sales force. We also expect share repurchases to be a continued growth driver.

Recommended Action: Buy PRI.