I just returned from the Beaver Creek Precious Metals Summit, one of the top mining conferences in the world, and I can tell you the mood was something like I haven’t seen since the early 2000s. The seeds of much larger gains are being planted, however, in three specific areas, notes Brien Lundin, executive editor of Gold Newsletter.

Suffice to say it was a hot bed of happiness. There were smiles all around, as the majority of junior mining companies have seen their share prices double or triple over the past couple of months.

(Editor’s Note: Brien will be speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

Granted, some companies have lagged. Some of those deserve to be left behind...while others seem poised to catch up soon. The latter represent extraordinary opportunities.

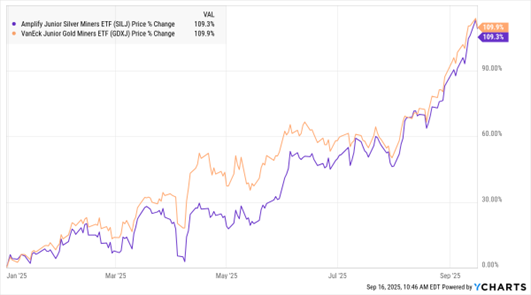

SILJ, GDXJ (YTD % Change)

Data by YCharts

First, gold and silver are headed much higher. I can’t tell you how many times I was asked, “How high is gold going, and how long will this last?” My answers were always the same: No one knows, so don’t believe anyone who tells you they do.

But if you use the three previous gold bull markets as a comparison, then this bull market will peak somewhere between $6,000-$8,000, with a small chance of going somewhere over $20,000 if there’s a full-on monetary reset with gold as the centerpiece.

The one thing we can be confident of is that a lot of money is being made at this very moment, and it seems very likely that much, much more will be made over the months and years ahead.

In the 2000s bull run, the initial move doubled and tripled the values of companies across the board. The entire market was bottomed out at the turn of the century, so there was a big catch-up necessary.

We’re seeing the catch-up period playing out now in the current market, as values are rising across the board. But much larger gains could be had in junior silver plays, companies with large gold and silver resources (and “optionality plays” with big resources that were previously uneconomic), and well-positioned exploration plays.