US markets rebounded on Wednesday as AI-related stocks rallied and word that the Supreme Court may be skeptical of the Trump Administration’s standing on tariffs emerged. In my Vanguard Moderate strategy, I recommend selling the Vanguard Mega Cap Value ETF (MGV) in favor of the Vanguard Mega Cap Growth ETF (MGK), says Brian Kelly, editor of MoneyLetter.

While the AI trade has been more volatile and appears to be tiring, the US economy continues to be resilient. Although government economic data is on hold, Wednesday’s ADP jobs and ISM Services data were both positive. Federal Reserve Chair Powell did cast doubt on a December interest rate cut recently, but odds currently are still in favor of a rate reduction.

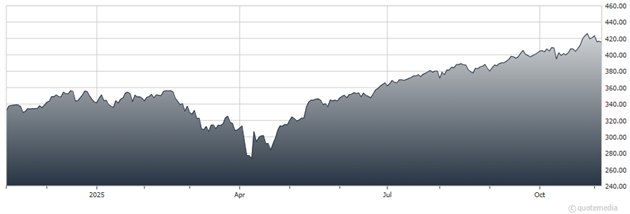

Vanguard Mega Cap Growth ETF (MGK)

Our global stock markets were all marginally lower for the reporting period. From Oct. 30 through Nov. 5, the S&P 500 Index (^SPX) was off 1.4%; the Euro Stoxx 50 declined 0.6%; the Nikkei 225 dropped 2.1%; and the Shanghai Composite was 1.2% lower.

While stock valuations are somewhat stretched, with a resilient economy and Fed policy still in our favor, we believe the near-term risks to equities are manageable. Maintain your current asset allocations, but do trim outsized value positions.

MGK seeks to track the performance of the CRSP US Mega Cap Growth Index. The index is a float-adjusted, market-capitalization-weighted index designed to measure the equity market performance of mega-capitalization growth stocks in the US.

Recommended Action: Buy MGK.