Norwood Financial Corp. (NWFL) is a bank holding company that operates through its subsidiary, Wayne Bank. It is an independent community bank with 16 offices in Northeastern Pennsylvania and 14 offices in New York, explains Ben Reynolds, editor of Sure Retirement.

It’s a small-cap stock, with a market capitalization of $244 million. But on July 7, it said it would acquire Pennsylvania-based PB Bankshares Inc. (PBBK) for $55 million, paid for 80% in NWFL stock and 20% in cash. PB Bankshares has $470 million in assets versus $2.4 billion for Norwood Financial. The merger is expected to be roughly 10% accretive to earnings per share (EPS) in 2026.

On Oct. 22, Norwood also released its third-quarter results. For the quarter, the company reported net income of $8.3 million, up from $6.2 million in the second quarter of 2025 and $3.8 million in the third quarter of 2024. Reported quarterly earnings per diluted share were $0.89, compared to $0.67 in Q2 2025 and $0.48 in Q3 2024.

The improved earnings reflect continued momentum following the strategic investment portfolio repositioning in the fourth quarter of 2024. Net interest income on a fully taxable equivalent (FTE) basis was $20.7 million during the quarter, an increase from $19.3 million in Q2 2025 (+7.2%) and $16.1 million in Q3 2024 (+28.2%).

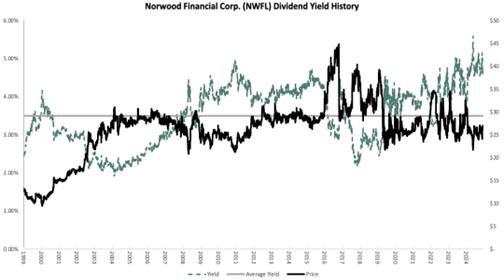

Norwood Financial is currently trading at a price-to-earnings ratio of 9.2, which is lower than the 10- year average earnings multiple of 13.8. We assume a fair price-to-earnings ratio of 12, which implies a valuation tailwind of 5.5% per year over the next five years. Also, given 5% expected growth of EPS and a 4.7% dividend yield, the stock could offer a total average annual return of 15.2% over the next five years.

Recommended Action: Buy NWFL.