Nvidia Corp.'s (NVDA) quarterly report on Wednesday will be a critical test for the high-flying Artificial Intelligence (AI) trade that has started to make some sputtering noises in recent weeks. The semiconductor giant became the world's first $5 trillion company last month, observes John Blank, chief equity strategist at Zacks Investment Research.

NVDA has lost a bit since. But with a staggering 8% weighting in the S&P 500 Index (^SPX) and major clout in many global indexes, it can easily sway markets on its own.

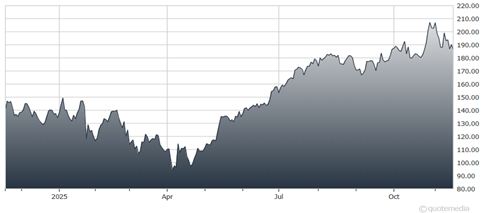

Nvidia Corp. (NVDA)

The AI bellwether's forecasts and the broader industry perspective will have ramifications for the wider tech ecosystem. It is going to either ease or feed those nagging investor concerns that this is already the next big bubble.

Meanwhile, US government number crunchers are beginning the task of shoveling out the backlog of data not released during Washington’s unprecedented 43-day shutdown. In 2013, which was the last shutdown to affect the all-important non-farm payrolls report, the figures came out five days after the government reopened.

Based on that timeline, traders could get the September numbers in the coming days – not least because the original release was planned for Oct. 3, just a couple of days after the shutdown began. Private data that has been published has suggested the labor market continues to weaken.

That supports the case for a December Federal Reserve rate cut. Officials are warning, though, that some data may have been lost forever, meaning the economic fog might take time to clear.