Netflix Inc. (NFLX) just bought an $82.7 billion headache. It dropped that much money to swallow Warner Bros. Studios and HBO Max through a buyout of Warner Bros. Discovery Inc. (WBD) — snapping up Harry Potter, Batman, Game of Thrones, and Casablanca like it was clearing out the bargain bin at a liquidation sale, suggests Keith Fitz-Gerald, editor of 5 With Fitz.

Hollywood romantics are calling it a dream merger. I think it's more like a multi-billion-dollar migraine. Why? Simple. If the “legendary” library were a real money printer, it wouldn’t have been on the clearance rack to begin with.

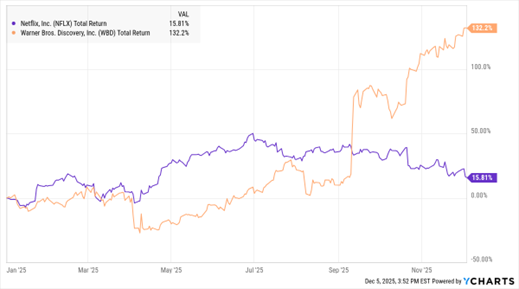

NFLX, WBD (YTD % Change)

Data by YCharts

Paramount Skydance Corp. (PSKY) attorneys are already crying foul, firing off a letter questioning the “fairness and adequacy” of the sale process — which is corporate-speak for “we lost, and we’re salty about it.” Regulators are sharpening their knives because this could be an e-ticket ride straight to antitrust heck. Sigh.

If you must play NFLX, forget about the price of the stock. I think there's a good case to be made that NFLX short-term volatility is seriously misplaced and that’s what you want to focus on. Or at least I do.

One way to do that is to target short-dated straddles because you're tactically going after abnormally high volatility, not making an investment play. Elevated IV often snaps back like a rubber band. And when you sell a straddle, you can make money even if the price doesn’t move a lot because falling IV crushes options values.

What's more, you don't need NFLX to calm down...just be “calmer” than expected. The key in situations like this one is disciplined “sizing” - meaning that you want just enough exposure to catch the volatility pop without blowing up your account if you're wrong. Again, purely tactical, not an investment play.