After a rough stretch for stocks, they’re stabilizing this morning. Everything from crude oil to precious metals to Treasuries and the dollar are mostly flat in the early going as well.

Former President and current Republican presidential candidate Donald Trump was convicted of 34 felony counts of falsifying business records late yesterday in a New York courthouse. Trump won’t be sentenced until July 11, though, so he is free to campaign in the meantime.

While Trump and his supporters unsurprisingly slammed the verdict as unjust, it remains to be seen if the guilty result leads to a shift in the polls. Most have shown him to have a slight edge over President Biden in key states. Meanwhile, as big as the story is in the political and legal arenas, it didn’t have a significant impact on financial markets. The price of stock, oil, and gold futures didn’t shift much after the news was released following yesterday’s 4 p.m. Eastern stock market close.

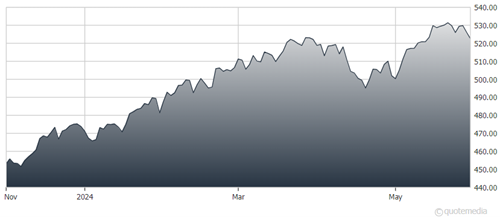

S&P 500 ETF Trust (SPY)

Speaking of markets and elections, YCharts recently released an analysis of what presidential contests “mean” for stocks – and how they’ve fared under recent Trump and Biden administrations. The study also looked at the makeup of Congress and how that factors in.

A couple of key points: The S&P 500 tends to rise between election and inauguration day REGARDLESS of which party’s candidate wins (likely because of uncertainty being lifted). Meanwhile, divided Congresses (with one party controlling the House and the other controlling the Senate) are usually better for stocks.

Finally, personal income and spending data for April was released this morning – and the report contained a closely watched inflation reading. The core Personal Consumption Expenditures (PCE) Index rose 0.2% last month, slightly below the 0.3% gain economists were expecting. ANY good news on the inflation front will be greeted with a smile on Wall Street because it keeps Federal Reserve interest rate cuts in play.