Selling overseas is translating into selling here, with equities broadly lower. Gold, silver, and the dollar are rising, though, as are long-term Treasuries.

Remember back in 2011-2012 when you’d wake up every morning to selling pressure coming from Europe? Selling driven by the eurozone’s government debt woes? Well, we’re seeing “Part Deux” now. French bonds and stocks are tumbling this week because elections in that country are raising investor concerns.

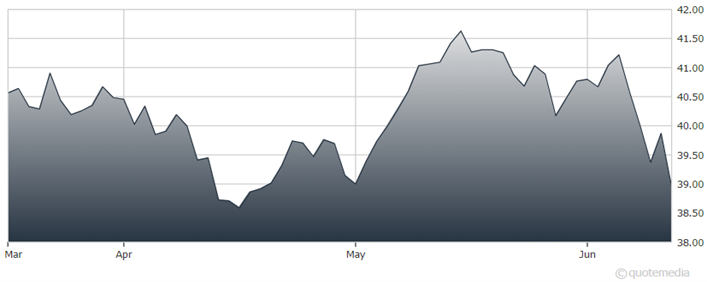

Specifically, centrist President Emmanuel Macron is losing power and influence to right-wing opponent Marine Le Pen. That could lead to laxer fiscal policy and less progress taming France’s expanding budget deficit. Investors are dumping French government bonds in response, driving prices lower and interest rates higher. That’s hurting European (and US) equities. The iShares MSCI France ETF (EWQ) is down 7% in the last month.

iShares MSCI France ETF (EWQ)

Meanwhile, Adobe Inc. (ADBE) shares are soaring after the maker of graphics software reported a surge in recurring revenue and raised its full-year profit forecast. The news suggests customers are warming to the Artificial Intelligence (AI) enhancements it has built into popular products like Photoshop and Illustrator. ADBE had been down 23% year-to-date, but it’s on pace to rise more today than on any day since March 2020.

Finally, yesterday’s economic data added to optimism over inflation and potential Federal Reserve interest rate cuts. The Producer Price Index (PPI) dropped 0.2% in May, while the core PPI held steady. Both wholesale inflation readings were well below economist estimates, and they followed news on Wednesday that consumer inflation cooled last month, too. Rate futures markets are now pricing in a 61% chance of an initial Fed cut in September, up from 47% a week earlier.