Stocks were wildly divergent again yesterday, with leaders dumping and laggards jumping. More on that in a minute. This morning, trading activity has settled down a bit in equities. Gold and silver are flat along with Treasuries, crude oil is lower, and the dollar is a bit higher.

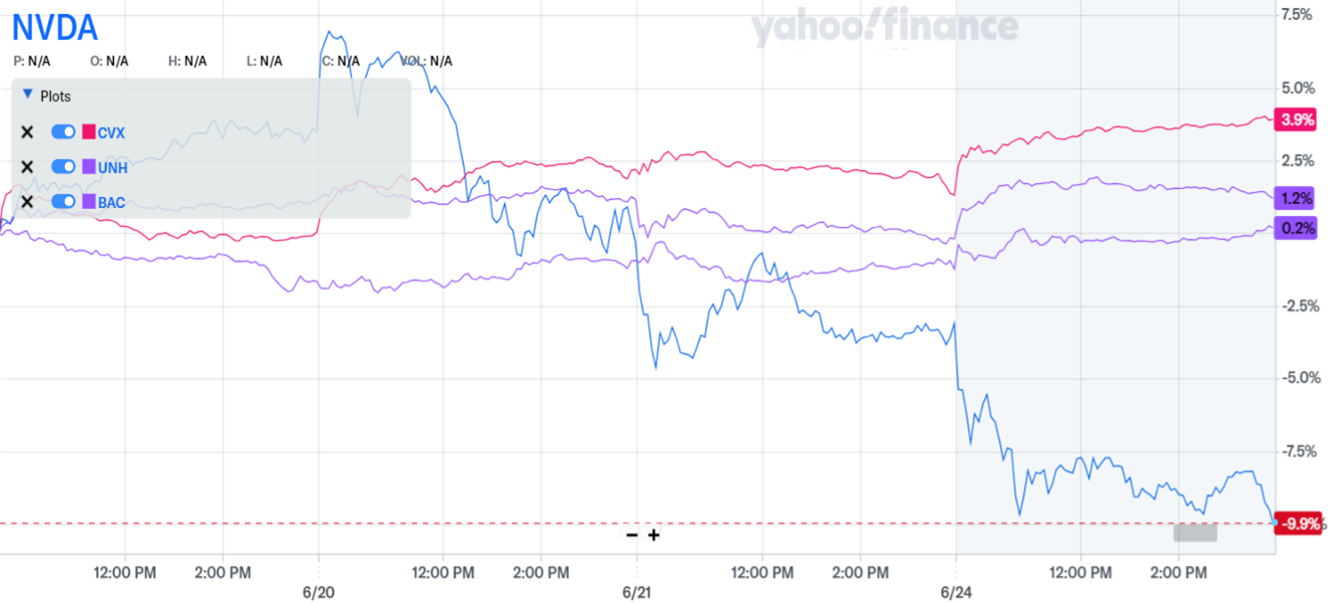

Now about the market rotation I first highlighted last week? Holy cow has that intensified! Yesterday, the Dow managed a 260-point, or 0.67%, rally. The Nasdaq Composite tumbled 192 points, or 1.09%. That’s because technology stocks like Nvidia Corp. (NVDA) dropped sharply even as energy, health care, and financial names like Chevron Corp. (CVX), UnitedHealth Group Inc. (UNH), and Bank of America Corp. (BAC) rallied.

NVDA, CVX, UNH, BAC (5-day % Change)

Source: Yahoo Finance

Investors are selling winners and buying laggards they think might play “catch up.” Ultimately, I believe that’s healthy for markets. We need to see a broader rally if we’re going to sustain this advance longer term, and I recently advocated bargain-hunting in left-behind groups like small caps as a solid H2 strategy. You just don’t want to see the former leaders selling off TOO aggressively, because that can take down the whole market.

Meanwhile, one of the Federal Reserve’s most hawkish policymakers weighed in from London today. Michelle Bowman said she wants to hold interest rates steady “for some time” because she still sees “a number of upside inflation risks.” That said, rate futures traders have pretty consistently been pricing in a high likelihood (60%-plus) of a rate cut at the Fed’s September meeting. They’re currently pricing in an extremely low chance (~5%) of NO cuts by December.