Talk about ROTATION! Yesterday was a wild day where the small caps struck back and big cap tech tumbled. The S&P 500 fell 0.9%, the Nasdaq finished down 364 points (-1.9%) and a Bloomberg index tracking “Magnificent Seven” stocks plunged 4.2%. But the Russell 2000 finished UP 73 (+3.5%). That was the widest one-day performance spread between the S&P and the Russell since March 2020.

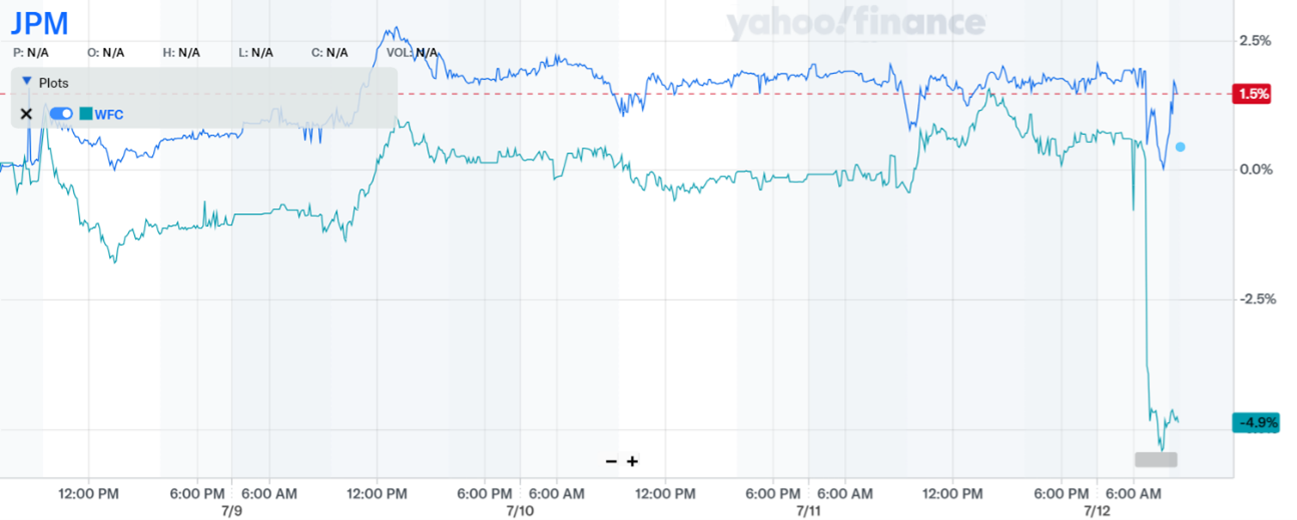

Second-quarter earnings season is underway! Mega-cap mega-bank JPMorgan Chase & Co. (JPM) delivered a big number: Profit of $18.15 billion, or $6.12 per share. That was up 25% from a year ago. But one-time items padded results. The results were more modest once you stripped those out, and net interest income was somewhat disappointing. The stock dipped in early trading.

JPM, WFC (5-day % Change)

Source: Yahoo Finance

Wells Fargo & Co. (WFC) fared worse, wither higher expenses, declining net interest income, and a rise in operating losses eating into profit. Net income slipped to $4.9 billion, or $1.33 per share, and the stock gave back more than 5% in early trading.

We got our second look at inflation in June today, this time on the wholesale level. The headline Producer Price Index rose 0.2%, while the core index popped 0.4%. Those numbers were both hotter than forecasts, which called for +0.1% and +0.2%, respectively. Still, they aren’t as important as the consumer readings we’ve recently seen.

In fact, the news on consumer inflation was so positive this week that the Wall Street Journal just published an article called “It’s Time for the Fed to End the Waiting Game.” The gist? Why wait until September to start cutting interest rates. Do it sooner. The Fed’s next meeting concludes July 31. Still, futures markets were only pricing in about a 7% chance of a 25-basis point cut at that gathering as of this morning.