Stocks are modestly higher again in the early going along with Treasuries. Gold is closing in on a fresh high, while crude oil is weaker and the dollar is up.

Smaller capitalization stocks are killing it so far in July. The iShares Russell 2000 ETF (IWM) has surged 7% so far this month, while the underlying index just hit its highest since January 2022. In fact, the Russell has risen more than 1% for four days in a row – something that has only happened 13 times since it was created in 1979.

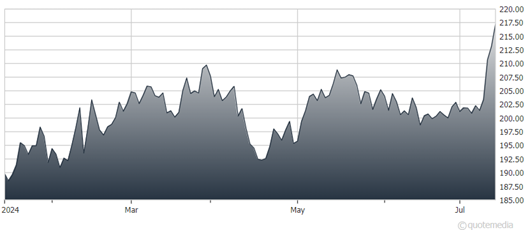

iShares Russell 2000 ETF (IWM)

Former President Trump named Ohio Senator J.D. Vance as his vice president at the Republican National Convention in Wisconsin. That has only added to “Trump Trade” momentum – gains for things like energy and financial stocks, as well as Bitcoin and gold. The Treasury yield curve has also been steepening, a trend that was already underway but that’s gaining added momentum. I wrote about it and what it means for investors in my MoneyShow Chart of the Week column yesterday.

Private credit is a booming business, and firms like Blue Owl Capital Inc. (OWL) keep doing deals to get a bigger slice of the pie. The firm said it would buy Atalaya Capital Management for as much as $800 million, adding that firm’s $10 billion in managed assets to its own $174 billion.

Private credit firms compete with traditional banks in making loans, but don’t face some of the same regulatory and growth constraints. Money is flowing into the space as a result, which is helping fuel growth. But it could also increase financial stability risk over the longer term by moving default risk into the more-opaque “shadow banking” sector versus the traditional banking world.