Stocks got rocked yesterday, with the selling we’ve seen in “Big Tech” recently spreading to the Dow, the small caps, and other groups that were previously benefitting from sector rotation. Even gold and silver got knocked around.

This morning, precious metals are selling off again while stocks are mixed. Crude oil is flattish, along with the dollar and Treasuries. But trading in some global markets was impacted by the massive, worldwide IT problem that I’ll talk about in a minute. Bankers, traders, and even stock exchanges had trouble logging in, handling orders, and disseminating news.

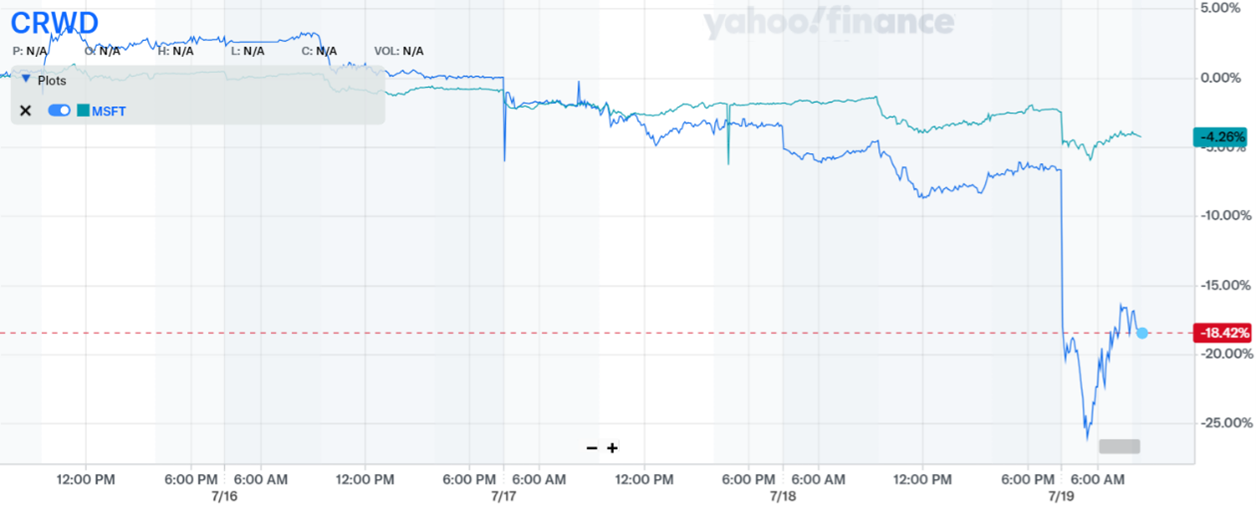

CRWD, MSFT (5-day % Change, Including Extended Hours)

Source: Yahoo Finance

Now to the outages. Banks, grocery stores, fast food retailers, airlines and airports, television broadcasters, and many corporations worldwide suffered IT problems reportedly tied to a software update by the cybersecurity firm CrowdStrike Holdings Inc. (CRWD). The firm’s software is widely used to prevent hackers from breaking into systems. But a new update that was pushed out by CRWD apparently crashed many systems running Microsoft Corp.’s (MSFT) Windows operating system.

CrowdStrike CEO George Kurtz said the firm had identified the issue and sent out a fix. But with such widespread damage – coming at a time when tech stocks were already under pressure – it will undoubtedly cause some jitters on Wall Street (and Main Street, too). CRWD and MSFT shares were both falling in early trading.

In other news, Netflix Inc. (NFLX) reported a 16.8% rise in Q2 sales and earnings per share that beat the $4.74 average estimate. The streaming media company also added more than 8 million users in the quarter. But the stock was mixed in post-earnings trading due to a lackluster revenue forecast for Q3. For its part, global credit card giant American Express Co. (AXP) beat quarterly EPS forecasts and raised its full-year target, citing increased scale, tamer expenses, and other factors. Its shares were muted, too.