Stocks were subdued yesterday and they’re quiet in early trading again today. Gold and silver are up a bit, crude oil is down a bit, and the dollar and Treasuries are mostly flat.

Why is it so quiet? Because this is “Central Bank Season.” Investors are waiting to hear from central banks in Japan, the UK, and the US this week – and they don’t want to make any big moves until they know what interest rates are going to do. Rate futures markets are only pricing in a 4% chance of the Fed cutting rates TOMORROW...but a 90% chance they’ll be cut at the next meeting in September.

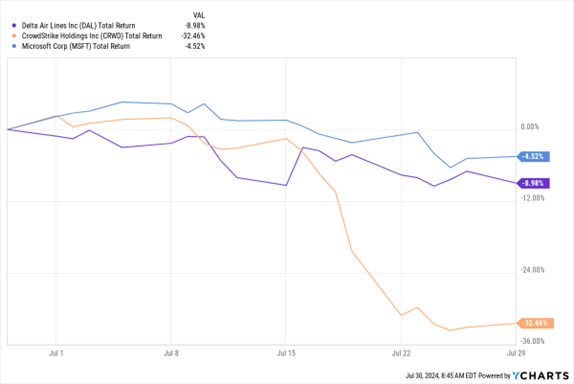

Delta Air Lines Inc. (DAL) struggled mightily to come back from the IT outages driven by the ill-fated CrowdStrike Holdings Inc. (CRWD) software update. Now, after cancelling more than 6,000 flights, Delta reportedly will seek compensation from CRWD and Microsoft Corp. (MSFT). The glitches reportedly cost Delta as much as $500 million.

DAL, CRWD, MSFT (1-Month % Change)

Data by YCharts

Former pharmaceutical powerhouse Pfizer Inc. (PFE) has fallen on hard times in the wake of the Covid pandemic. Sales of its Covid vaccine and pill have since plummeted, and its shares have followed suit. But the company just raised its 2024 earnings forecast, citing an aggressive cost-cutting plan. Plus, management is counting on recent acquisitions and a rebuilt drug pipeline to spur future growth. The stock is up modestly today.

Finally, I’m leaving for our MoneyShow Masters Symposium Las Vegas today. I hope to see you there! Because of my on-site duties, I won’t have a new Market Minute column for you until Monday, Aug. 5. You WILL have access to stock digests all week, though...AND our newest MoneyShow MoneyMasters Podcast episode Thursday. So, be sure to check those out!