Stocks ripped higher yesterday, though most markets are subdued in the early going today. That includes equities, precious metals, crude oil, Treasuries, and the dollar.

Yesterday’s Producer Price Index (PPI) fueled optimism on the inflation front. Today’s Consumer Price Index (CPI) confirmed – but didn’t ENHANCE – that optimism. Specifically, both the headline and “core” CPI that excludes food and energy rose 0.2% in July. That matched economist estimates. The year-over-year headline rate inched down to 2.9%, slightly below the 3% expected.

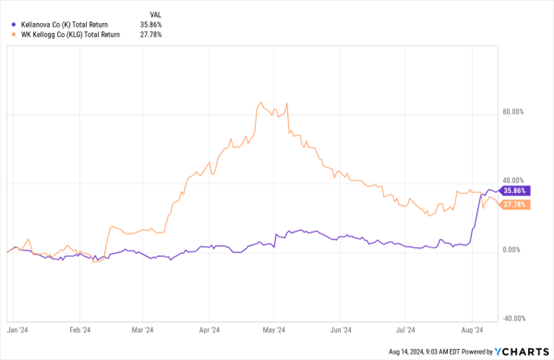

We have a mega-merger...in the packaged foods business! Privately held Mars is buying Kellanova (K) for a whopping $36 billion, the largest acquisition in that sector EVER. K itself was spun out from WK Kellogg Co. (KLG) last October, with the latter retaining the cereal business it’s best known for.

K, KLG (YTD % Change)

Data by YCharts

Mars will add Kellanova brands like Cheez-It, Pringles, Pop-Tarts, Carr’s, and Eggo to its lineup, which includes M&M’s, Snickers, Altoids, Orbit, and Kind. Mars is paying $83.50 in cash for K, a 33% premium to where it traded before reports of a potential deal emerged earlier in August. Mars’ largest prior deal was its $23 billion purchase of Wrigley in 2008.

Could Alphabet Inc. (GOOGL) be broken up? US antitrust regulators are reportedly considering that option now that a court found that the Google owner monopolized the Internet search business. The Justice Department could force Alphabet to divest its Android operating system, its Chrome browser business, or other units.

Should the government pursue that option, it would be the first such action since it tried to break up Microsoft Corp. (MSFT) a couple decades ago. If it were to succeed, it would be the biggest US-driven corporate breakup since AT&T in the 1980s. Deliberations on how to move forward are ongoing.