Stocks are looking to finish the week on a high note after a mixed day yesterday. Oil, gold, and silver are pulling back modestly, while the dollar is up and Treasuries are flat.

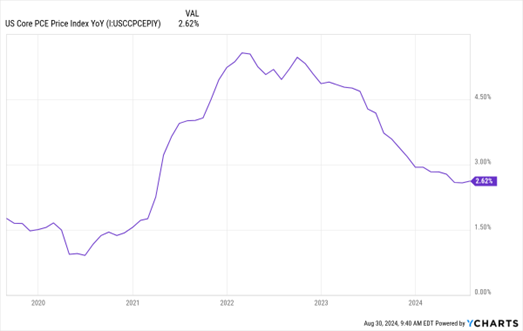

The Federal Reserve is all but certain to cut interest rates at its September meeting, as long as the data on inflation continues to come in as expected, that is. On that front, the latest personal consumption expenditures (PCE) figures were encouraging.

Both the headline and “core” PCE rose just 0.2% in July, in line with forecasts. On a year-over-year basis, the core PCE was up just 2.6% -- roughly the least since 2021. That tees up at LEAST a 25-basis point rate cut at the Fed’s Sept. 17-18 gathering. We could get a 50 bp cut instead if upcoming jobs data shows more softness in the labor market.

Data by YCharts

OPEC+ members will meet soon to discuss output levels, and it appears they will roll back some of their previously implemented cuts. Specifically, they could boost output by 180,000 barrels per day starting in October – while keeping the remainder of the 2.2 million BPD reduction they agreed to in place through the end of 2025. In OPEC’s view, that will help compensate for a drop in output from Libya without tanking prices.

Chipmaking giant Intel Corp. (INTC) has been foundering – so much so that the company is reportedly considering splitting itself up or pursuing a transformational acquisition. Bloomberg reported the company is working with investment bankers at Morgan Stanley (MS) and Goldman Sachs Group Inc. (GS) to figure out a way forward. INTC shares have plunged 60% this year, sinking to their the lowest in more than a decade.

Please Note: There will be no Top Pros’ Top Picks newsletter on Monday because markets are closed for the Labor Day holiday. I hope you enjoy some well-earned R&R with your family and friends!