Stocks finished August with a rally, but they’re starting September with a slump. Oil is also pulling back, while gold and the dollar are flat. Treasuries are higher.

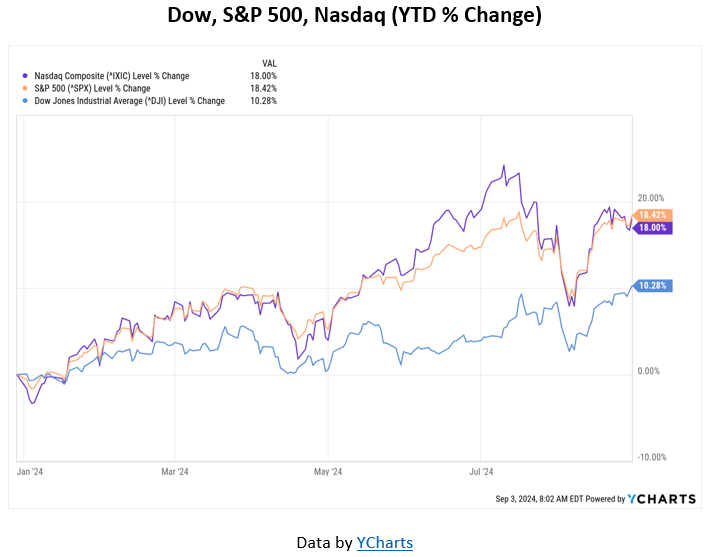

The good news? The stock market has had a great year so far, with the S&P 500 and Nasdaq Composite both up around 18% and the Dow Industrials up 10%. We’ve also seen the advance broaden out to include more than “just tech.” The bad news? We’re entering one of the seasonally weakest times of year. Stocks are pretty pricey, too. I’m still in the “Be Bold” camp when it comes to stocks...but September and October can be bumpy months.

While it’s a holiday-shortened trading week, there is NO shortage of economic data for investors to digest. Manufacturing and construction spending numbers are being released today, while the “JOLTS” jobs report comes out tomorrow. We get the ADP employment numbers for August on Thursday, followed by the official Labor Department ones on Friday.

Friday’s report will be one of the last big ones before the Federal Reserve’s September policy meeting. Markets are all but certain the Fed will cut rates by 25 basis points from the current range of 5.25% to 5.5%. They’re also pricing in a roughly 1-in-3 chance the Fed will go 50 bps. Softer employment numbers would undoubtedly boost those odds.