Stocks are trying to bounce back in early trading after a lousy start to the month. Crude oil is a bit higher along with the dollar, while Treasuries and gold are flattish.

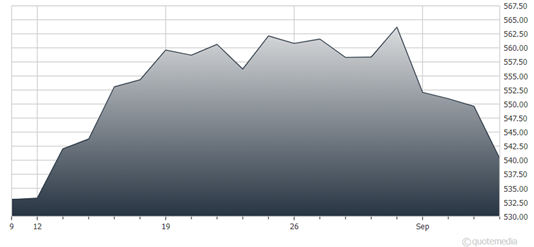

Yes, the stock market is doing “September Things” this year. The S&P 500 shed 4.2% of its value last week, while the Nasdaq Composite dropped 5.8%. That was the worst week for the tech-heavy index since January 2022. Nvidia Corp. (NVDA) lost 14%, with its $406 billion dump in market capitalization the most value lost in a week by any company in history.

Seasonal weakness is normal, with the S&P 500 losing 1.2% on average in September going back to 1928. But this year, uncertainty is even higher than usual. The presidential election looks like a toss-up, for one thing. Plus, some investors are worried the economy is on the brink of recession rather than a soft landing.

S&P 500 ETF Trust (SPY, 1-Month Chart)

Meanwhile, markets aren’t sure how much the Federal Reserve will cut interest rates in the coming months. The next Fed meeting concludes Sept. 18. Then there are two more gatherings in 2024 – plus a handful in early 2025. All of them could be “live”...meaning meetings at which policymakers might lower interest rates. The last major economic report on tap before the September meeting is this Wednesday’s August Consumer Price Index (CPI).

Finally, troubled retailer Big Lots Inc. (BIG) filed for bankruptcy. At the same time, it agreed to sell company assets to the private equity investment firm Nexus Capital Management LP – and secured $707.5 million in financing to keep it operating for now. The discount retailer had more than 1,300 US stores as of May. Its filing is just one of the 21 retail bankruptcies S&P Global tallied through mid-year, the worst for the sector since 2020.