Stocks slumped after a key inflation report wasn’t as bullish as some hoped. Meanwhile, all other markets were volatile in the immediate aftermath of the data – but mostly unchanged from the prior day’s levels. Oil is the one exception, up notably from Tuesday.

Today’s Consumer Price Index (CPI) report was the last MAJOR economic release ahead of the Federal Reserve’s policy meeting next week. Economists expected CPI to rise 0.2% on both the headline and core in August. It gained 0.2% and 0.3%, respectively. On a year-over-year basis, core inflation is now rising just 3.2% -- FAR below its June 2022 peak of 6.6%. Headline inflation came in at 2.5%, the lowest in 43 months.

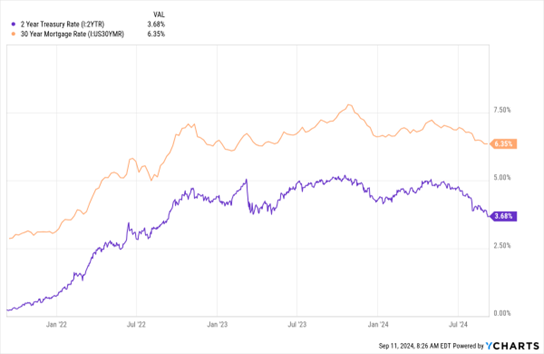

Interest rates have been falling – at both the short AND long end of the curve. Two indicators: The yield on the 2-year Treasury Note yield just sank to 3.55%, its lowest since September 2022. Meanwhile, the average rate on a 30-year fixed mortgage just dropped another 14 basis points to around 6.3%. That’s the lowest since February 2023. The latter move is spurring a pickup in mortgage refinance activity, though not all that much of one becuase many borrowers are locked into 30-year loans in the 5s, 4s, 3s, and even 2s!

2-Year Treasury Yield, 30-Year Mortgage Rate

Data by YCharts

Washington pundits of every persuasion will spin last night's 2024 presidential debate in different ways. But the great thing about markets is that you can follow real money flows to track perceived win/loss chances in real time. Overnight and this morning, the odds of a Kamala Harris win have risen on various betting sites.

Another “election chance proxy” indicator many are following: Shares of Trump Media & Technology Group Corp. (DJT). They fell as much as 13% in the pre-market, before bouncing a bit. They’re up more than 6% year-to-date, but also down 61% in the last 90 days.