Gold is the star of the market show these days, jumping again yesterday and climbing further this morning. It just hit a fresh all-time high of $2,684 an ounce, extending its year-to-date gain to almost 30%. Stocks and the dollar are flattish, while crude oil and Treasuries are a bit lower.

Yesterday, we got the mega-stimulus measures out of China that were rumored earlier this week. The People’s Bank of China cut an important short-term interest rate and lowered reserve requirements for Chinese banks, a move that should free up more money for lending. Policymakers also eased rules that pertain to second-home purchases and said they’re considering establishing a stock market stabilization fund.

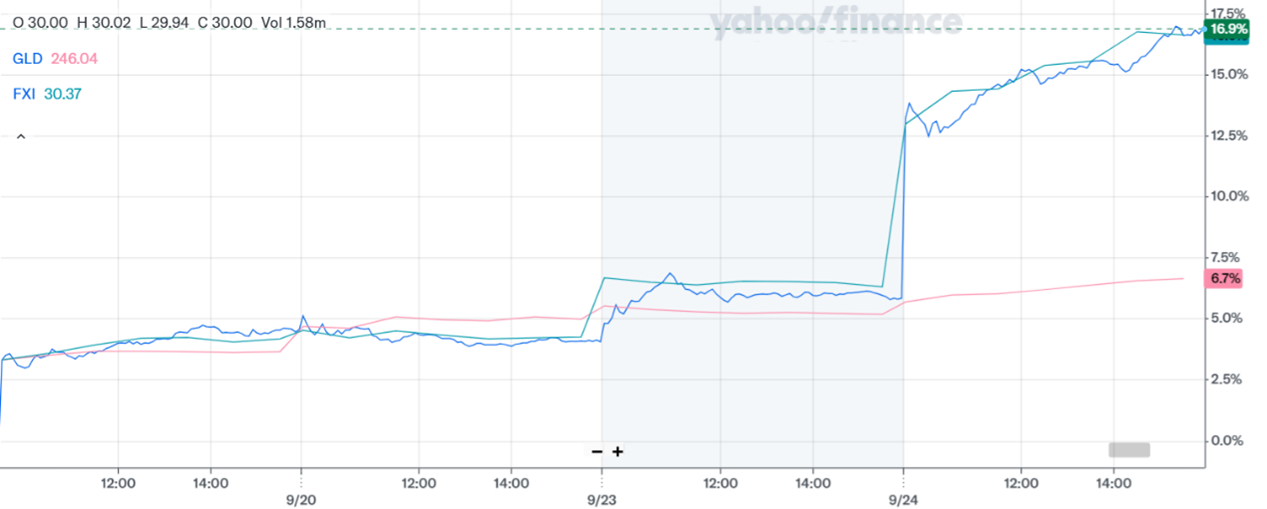

China’s CSI 300 Index rose more than 4% in response. Here in the US, the iShares China Large Cap ETF (FXI) surged 9.8% yesterday. Another popular fund, the KraneShares CSI China Internet ETF (KWEB), jumped 10.3%.

FXI, KWEB, GLD (5-Day % Change)

Long a subject of European Union antitrust scrutiny, Alphabet Inc. (GOOGL) has turned around and...filed an EU antitrust complaint against Microsoft Corp. (MSFT). Alphabet’s Google arm says Microsoft is abusing its dominant position in business software to drive customers to its Azure cloud services division. That said, it will take years for regulators and possibly the court system to pursue and/or rule on the allegations.

Falling interest rates are working their magic on the mortgage market. The average 30-year home loan rate fell for the eighth week in a row to 6.13%, according to the Mortgage Bankers Association. Refinance activity surged more than 20% in response, hitting its highest since April 2022. Applications for home purchase mortgages hit the highest since February.