Stocks finished last week on a high note. But they’re sliding today thanks to rising crude oil prices and rising interest rates. The dollar is flat.

Crude oil has been getting tugged in two directions, but the bulls have the upper hand today. On the one hand, Israel is still planning some kind of retaliation for Iranian missile attacks. Traders fear Iran’s oil production or processing facilities could get hit, taking supply off the world market. Meanwhile, a political resolution in Libya is boosting production in that country. Output had plunged by about 800,000 barrels per day for several weeks due to infighting between factions in the North African nation.

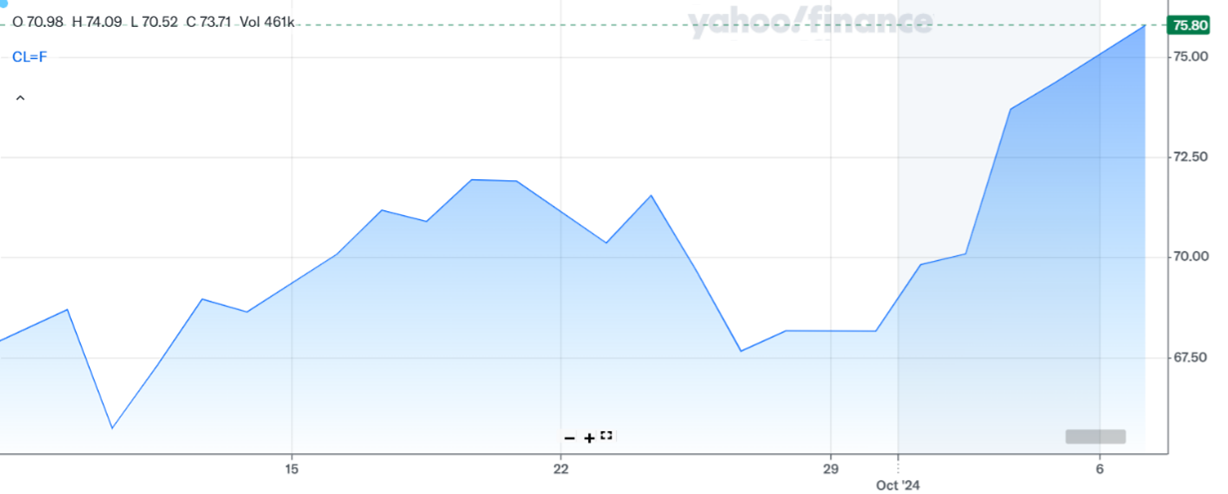

Crude Oil Futures (1-Mo. Chart)

As for interest rates, the yield on the 10-year US Treasury just topped 4% for the first time since August amid a “rethink” of Federal Reserve policy. The blowout jobs number on Friday caused traders to curtail bets on aggressive Fed easing, with markets pricing in a slight chance we do NOT get two 25 basis point cuts at the meetings scheduled for November and December.

Things could change this week, however, depending on what the CPI and PPI inflation reports show on Thursday and Friday. Several Fed speeches are also on the docket this week, along with consumer sentiment and trade reports.

Finally, gold has been on fire all year – and Costco Wholesale Corp. (COST) has cashed in by selling millions of dollars’ worth of gold bars. Now, the retailer is adding one-ounce platinum bars to the mix. Consumers can purchased them for around $1,090 – a premium of almost $100 to where platinum futures are trading right now.