I wanted to start today’s column by thanking you for your patience and concern before, during, and after Hurricane Milton. Our team is working hard to get fully back up and running in Sarasota, and we’re fortunate that our staff and our office are faring okay, despite some challenges.

We know many others were not as fortunate, however. As long-time Floridians, we have deep personal and business ties throughout the region and the state – and we want to extend our best wishes for a speedy recovery to each and every one of them. We also want to thank the thousands of first responders, government workers, and private volunteers who have converged on Florida to help storm victims, and to get our great state back on its feet.

With that said, stocks are flattish this morning along with Treasuries and the dollar. Gold and silver are rising, though, while crude oil is modestly lower.

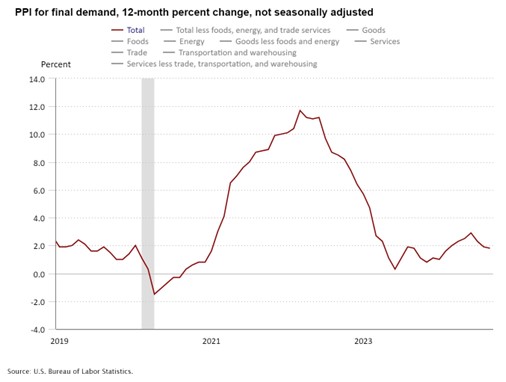

Inflation has been the big story this week, with the Consumer Price Index (CPI) coming in a bit hotter-than-expected yesterday...and the Producer Price Index coming in roughly in-line this morning. The headline PPI was up 1.8% year-over-year in September, while the core PPI was up 2.8%. The comparable CPI numbers were 2.4% and 3.3%, respectively.

Those numbers are certainly better than we had in 2023 and 2022. That should allow the Federal Reserve to continue cutting interest rates. But it will likely do so in more gradual steps – meaning 25 basis points at upcoming meetings versus the 50 bps cut we saw in September.

Finally, the Q3 earnings season is officially underway! JPMorgan Chase & Co. (JPM) reported profit of $12.9 billion, or $4.37 per share. That topped the average $3.99 estimate of analysts. But a big rise in credit loss provisions (to $3.1 billion from $1.4 billion a year ago) dampened some of the market’s enthusiasm.