Stocks are mixed in the early going today. Crude oil, gold, and silver are lower, while the dollar is up. The bond market is closed for Columbus Day.

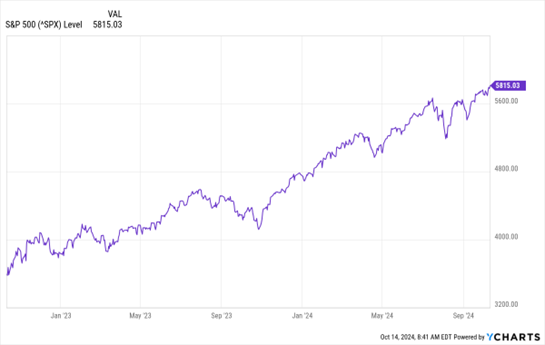

It’s official! The current bull market is now two years old. During that time, the S&P 500 has surged more than 60% -- and hit a series of all-time highs. But multiple MoneyShow expert contributors believe markets still have more gas in the tank. 2024 MoneyShow Toronto speaker Brian Belski, for one, recently raised his year-end 2024 price target to 6,100 from 5,600.

Data by YCharts

After an initial explosive surge, followed by a pullback, Chinese stocks are on the rise again. The benchmark CSI 300 Index climbed 1.9% after the government filled in some blanks regarding its planned economic stimulus efforts. Investors are anticipating a bigger dose of fiscal spending to complement monetary policy easing from the People’s Bank of China. All told, the new outlays could total around 2 trillion yuan – or roughly $283 billion.

Looking for a bargain on the used-car lot? Consider an Electric Vehicle (EV)! While EVs were priced at a premium to gas-powered cars a couple years ago, that has mostly reversed in the resale market.

Experts blame a glut of EVs, flagging interest from buyers, and price cuts in the new-EV market that have had a follow-on impact in the used-EV arena. Edmunds says a three-year-old EV now goes for around $28,400, down 25% from 2023. Tesla Inc. (TSLA) has been particularly aggressive with cutting prices, leaving some previous buyers “upside down” on their auto loans.