Stocks rolled over yesterday, though the Nasdaq managed to eke out a gain. Equities are weaker in the early going again today, while gold, silver, and oil are all modestly higher. Treasuries and the dollar are flat.

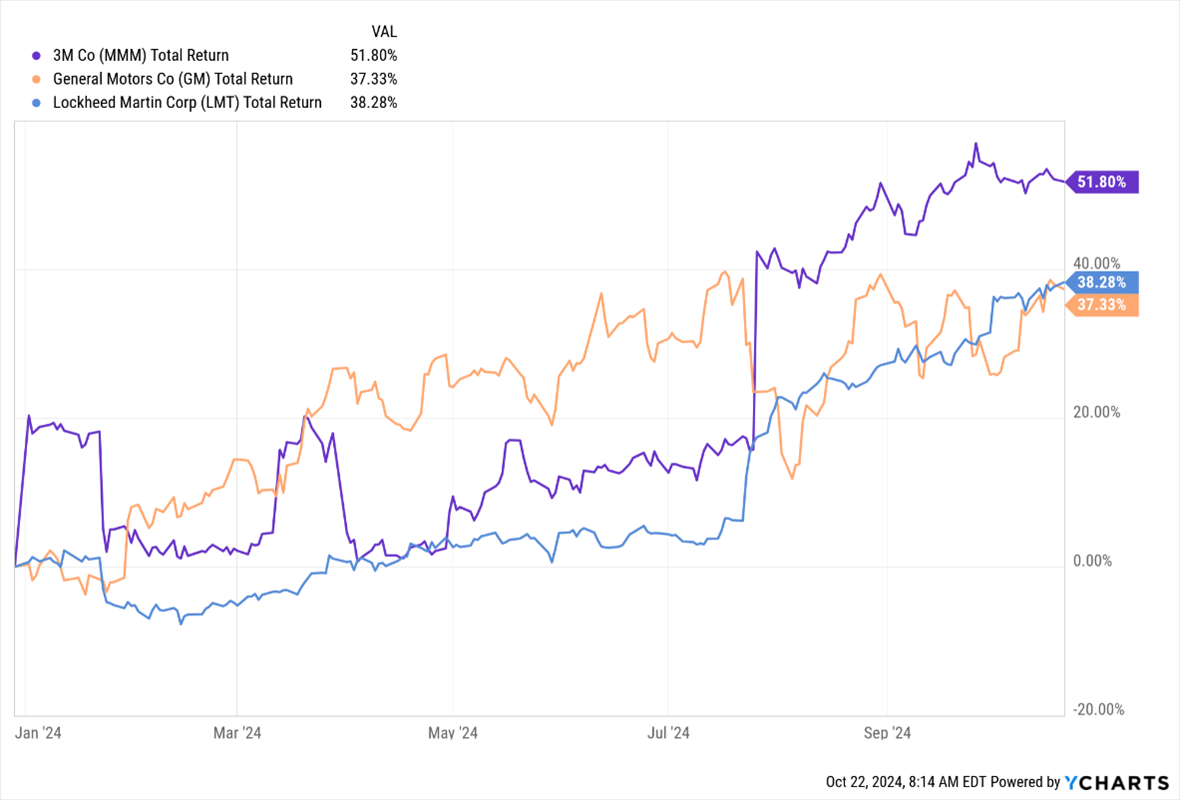

We’re in the thick of Q3 earnings season now, with heavyweights like 3M Co. (MMM), General Motors Co. (GM), and Lockheed Martin Corp. (LMT) all reporting in the last few hours. Shares of 3M climbed after the diversified manufacturer beat analyst earnings estimates due to strength in its electronics and industrial products operations.

Data by YCharts

Meanwhile, automaker GM topped forecasts, helped by an increase in North American profit margins. For its part, the defense contractor LMT raised its full-year sales and profit targets due to increased military spending tied to current and feared geopolitical conflicts.

Maybe the Federal Reserve will NOT be as aggressive as Wall Street would like. That’s the best explanation for yesterday’s lousy action, and today’s early weakness. Kansas City Fed President Jeff Schmid used terms like “cautious,” “deliberate,” and “gradual” to describe the rate-cutting process he would like to see.

Bond yields surged in response, with the 10-year Treasury just topping 4.2% for the first time in three months. At its lowest point in September, it was yielding around 3.62%. While rate futures markets are pricing in a roughly 90% chance the Fed cuts by another 25 basis points in November, the chance of a second cut in December has dropped to around 67% from 86% last week.