Gold continues to be the big story in markets. The metal rose again to a fresh record just over $2,800 an ounce before pulling back. Treasuries sold off after hotter-than-expected ADP jobs data, but modestly weaker-than-expected Q3 GDP data kept the selling from getting too aggressive. Equities were mixed recently, while crude oil was up.

It’s “Big Tech” earnings week, and Alphabet Inc. (GOOGL) hit one out of the park. The search engine giant reported earnings per share of $2.12, up 37% year-over-year and well above the average analyst estimate of $1.83. Revenue also topped forecasts, helped along by cloud computing demand and AI-related operations.

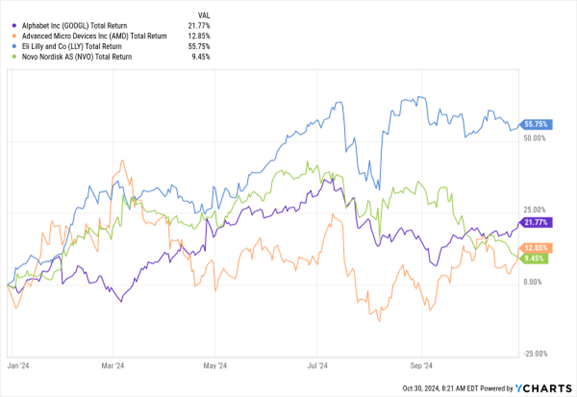

GOOGL, AMD, LLY, NVO (YTD % Change)

Data by YCharts

On the flip side, Advanced Micro Devices Inc. (AMD) couldn’t get it done. The semiconductor company’s sales and earnings for the most recent quarter matched targets, but it forecast lower-than-expected sales in the current quarter. GOOGL shares rose more than 6% in early trading, while AMD shares fell by just over 8%.

A drugmaker reporting WEAKER-than-expected demand for a weight-loss drug? We haven’t seen that in a while. But Eli Lilly and Co. (LLY) just reported (relatively) disappointing sales of Zepbound and cut its full-year sales guidance. Rising manufacturing costs also resulted in the pharmaceutical giant missing Q3 profit estimates.

LLY is one of the top manufacturers of the new class of anti-obesity drugs, competing with Ozempic and Wegovy producer Novo Nordisk A/S (NVO). LLY shares were up 55% year-to-date through yesterday, while NVO shares were up 9%. Both are slipping in early trading today.