Equities faded yesterday, but they’re looking to regain some ground in the early going today. Gold and silver are lower along with Treasuries, while crude oil is a bit higher. Bitcoin is hugging $100,000 again.

This much is certain: The Federal Reserve WILL cut interest rates by another 25 basis points next Wednesday. As a result, the funds rate will drop to a range of 4.25% - 4.5%. This much is unknown: How many more cuts are coming in 2025...and when.

Most economists expect at least another couple of reductions next year, but not at every policy meeting. Plus, the rate-cutting outlook could change depending on what the inflation and growth data look like in Q1 and Q2.

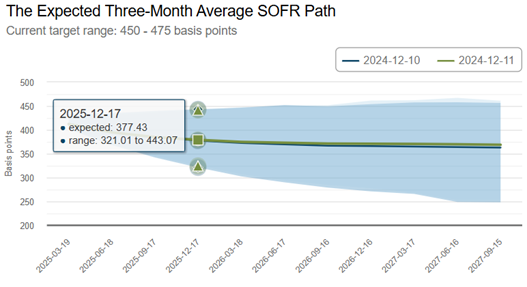

Source: Atlanta Fed

Markets are pricing in a “terminal” federal funds rate for this rate-lowering cycle of 3.75% - 4% for now. They expect the Secured Overnight Financing Rate (SOFR), used as a benchmark for corporate loans, derivatives, and other contracts, to hover roughly in that range or dip a bit lower in late-2025 and much of 2026.

Sure, the stock averages are rising. But many stocks aren’t participating. We just had a nine-day streak where the number of S&P 500 stocks FALLING topped the number of index constituents RISING. Bloomberg started tracking the data in 2004, and this is the longest streak ever. No surprise, then, that the equal-weighted S&P (vs. the market cap-weighted one) just slid for seven straight days – the most since 2018.

Finally, shares of Broadcom Inc. (AVGO) are soaring after the chipmaker forecast stellar demand for its semiconductors. The firm sells custom chips used in tech gear that fuels the Artificial Intelligence (AI) boom. CEO Hock Tan said the business could generate between $60 billion and $90 billion in revenue in fiscal 2027, far more than analysts expected.