Stocks rallied broadly yesterday, and they're trying to add to those gains in the early going today. Crude oil, gold, and silver are mostly flat along with the dollar. Interest rates are dipping.

Hot on the heels of announcing plans to hit Mexico and Canada with 25% tariffs Feb. 1, President Trump lobbed a new threat at China. He said he could implement a 10% tariff on Chinese goods as soon as February, too.

As always, it remains to be seen which tariffs Trump will actually implement – or if he will back off if those countries agree to trade concessions or other measures favorable to the US. Worth noting: Trump also called out the European Union (EU) and the $350 billion deficit the US has with that economic bloc yesterday.

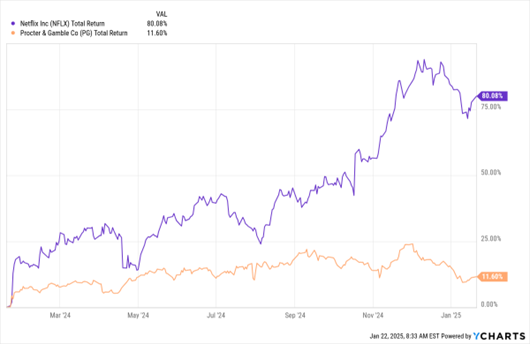

NFLX, PG (1-Year % Change)

Data by YCharts

On the earnings front, Netflix Inc. (NFLX) blew away subscriber growth expectations in the fourth quarter, adding 18.9 million users. The streaming entertainment company also launched a $15 billion stock buyback and projected higher-than-expected 2025 revenue. Shares surged as much as 14% in response, after already rising 80% in the last 12 months.

Finally, shares of the decidedly less-sexy consumer products giant Procter & Gamble Co. (PG) were also rising in early trading after it beat expectations. The company that makes Tide detergent, Pantene shampoo, and other household goods topped sales and earnings targets amid a 2% rise in organic volume. PG is up more than 11% in the last year.