Tech stocks got crushed yesterday amid shocking news out of China. But the Dow Industrials finished the day UP 0.65% amid an ongoing “sneaky” rotation. More in a minute. Meanwhile, Treasuries are down a bit, while the dollar is higher. Gold, silver, and crude oil are showing modest rallies, too.

Yesterday was a day that shook the tech sector to its core…and tech investors along with it. Nvidia Corp. (NVDA) plunged 17%, wiping out $590 billion in market capitalization in the process. That was the biggest loss of value for a single stock in US history. But the news of DeepSeek’s successful, yet bargain-basement, Artificial Intelligence (AI) model wreaked havoc far beyond Nvidia.

Several other semiconductor makers and related stocks sank in sympathy. So did shares of electric utilities and makers of equipment they use. Why? Investors rethought the idea that companies would have to build more and more enormous data centers for the AI tech boom...and would therefore need less electricity to power them.

Whether this is a seismic event signifying the end of the AI spending wave remains to be seen. But as I’ve been talking about since JULY 2024, we’ve seen rotational action behind the markets for a while – and the smart play has been to ride it for greater profits. Consider the two charts below.

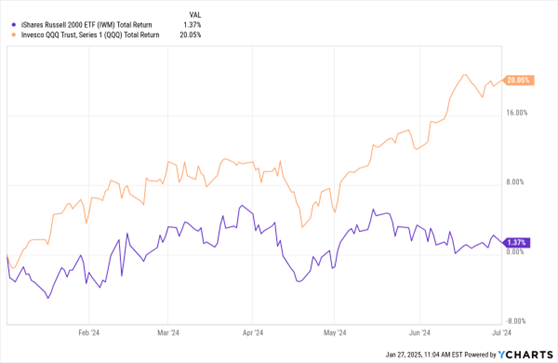

The first shows the performance of the iShares Russell 2000 ETF (IWM) and the Invesco QQQ Trust (QQQ) in the first six months of last year – and how it was no contest. The QQQs rose 20% during that time while the IWM rose just 1.3%. Tech was essentially the only game in town, with many other stocks lagging behind.

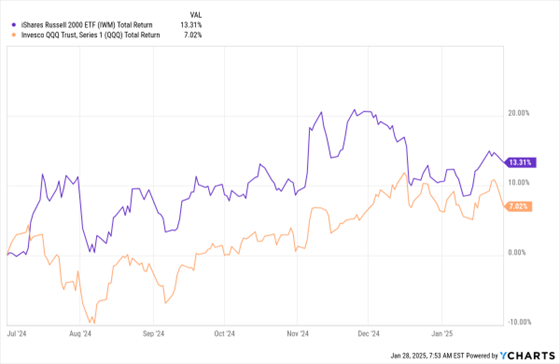

Then look at the SAME two ETFs from July 1, 2024 through yesterday. The IWM is up more than 13% in that time...almost TWICE the 7% return of the QQQ. If you chart the performance of sector ETFs that track financials, industrials, materials, and even real estate, you see the same thing. Notable OUTPERFORMANCE versus tech.

Pre-July 2024 IWM vs. QQQ

Post-July 2024 IWM vs. QQQ

Data by YCharts

Bottom line? Tech is an important part of any investor’s portfolio. But it shouldn’t be the only part. You’re making more money now – and you have been since last July – if you’re investing elsewhere. That just underscores why you have to focus on what’s happening behind the scenes (and what me and other MoneyShow experts have been talking about here!)