Stocks are easing back after Tuesday’s strong session, while gold, silver, and crude oil are mixed. Treasuries are flattish, while the dollar is modestly higher.

The stock market rallied back sharply yesterday on the back of vigorous dip-buying in Big Tech names like Nvidia Corp. (NVDA), Microsoft Corp. (MSFT), and Broadcom Inc. (AVGO). But even so, the DeepSeek plot thickened.

Microsoft and its Artificial Intelligence partner OpenAI are investigating whether individuals possibly linked to the Chinese firm siphoned off an enormous amount of data from Open AI in the fall. President Trump’s AI czar David Sacks weighed in, suggesting there was “substantial evidence” DeepSeek used OpenAI’s models to help develop its own. That could violate OpenAI’s terms of use.

Meanwhile, shares of chip equipment maker ASML Holding NV (ASML) initially surged the most since 2020 today after reporting strong results. The firm reported bookings of 7.09 billion euros, well ahead of the average analyst estimate of 3.53 billion euros.

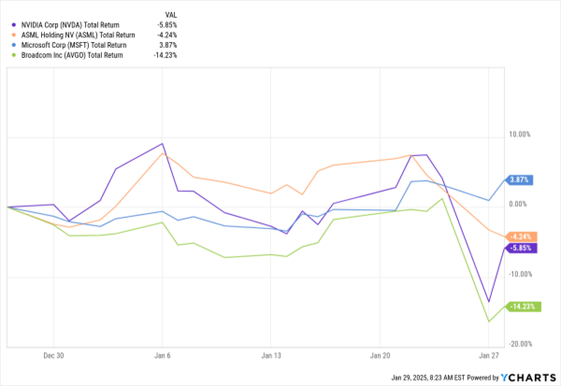

NVDA, ASML, MSFT, AVGO (1-Mo. % Change)

Data by YCharts

ASML was one of this week’s AI “collateral damage” names because advanced semiconductor makers use its gear to make their products, which in turn are used in AI-related hardware. Other key tech names will report earnings after the bell today, including Microsoft, Meta Platforms Inc. (META), and Tesla Inc. (TSLA).

In other news, the Federal Reserve concludes its latest meeting today. The Fed will NOT cut rates, but Wall Street will be watching closely to see what policymakers say about the future path of the federal funds rate. The Fed’s next meetings are scheduled for March, May, and June. Rate futures markets are currently pricing in a decent chance of another 25-basis point cut at one of the latter two gatherings.