It has been an ugly week across the board, with multiple asset classes under pressure. But stocks, gold, and even Bitcoin are trying to right the ship in early trading today. The dollar and Treasuries are flat, while crude oil is lower.

Cryptocurrencies. Tech stocks. Silver. Business Development Companies (BDCs). The sellers came for them ALL yesterday. Worries about Artificial Intelligence (AI) disrupting the highly lucrative enterprise software business and concerns that Big Tech is spending WAY too much on AI infrastructure pummeled stocks throughout the sector.

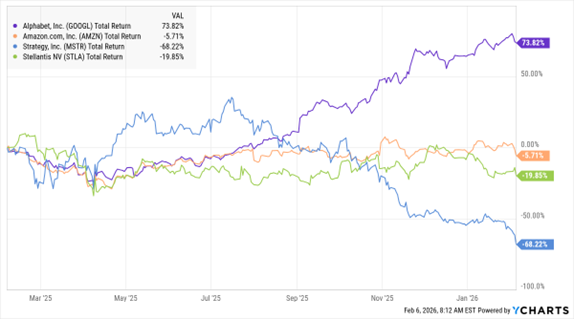

GOOGL, AMZN, MSTR, STLA (1-Yr. % Change)

Data by YCharts

Earlier this week, Alphabet Inc. (GOOGL) said it would spend a whopping $185 billion on capex this year. Analysts were expecting only $119.5 billion. Then late yesterday, Amazon.com Inc. (AMZN) said ITS capex bill would come to $200 billion in 2026. That would represent a huge increase from the $125 billion it spent in 2025. The firm also missed operating income estimates in Q1 – and said it would wind down some operations like its Amazon Fresh and Go stores.

Meanwhile, liquidation selling in silver knocked that precious metal to as low as $64 an ounce overnight – just ONE WEEK after it traded above $121. And in the crypto space, Bitcoin briefly dipped below $60,000 before rebounding to $66,000 later this morning. It topped $126,000 back in October.

Falling prices caused Michael Saylor’s Strategy Inc. (MSTR) to lose a whopping $12.4 billion in Q4. It had to take enormous mark-to-market losses on the Bitcoin it has been accumulating with money it raised selling equity and debt. Strategy stock has lost around 68% of its value in the last 12 months.

Finally, Stellantis NV (STLA) became the latest automaker to do an EV about-face – and pay through the nose for it! The maker of Jeep and Fiat vehicles announced a $26 billion charge related to exiting battery and EV ventures. Stellantis stock tanked on the news; it already was down 19.8% in the past year.