Stocks are liking the latest labor market data, while Treasuries are…not. Meanwhile, gold, silver, and crude oil are all nicely higher – though most cryptocurrencies are continuing to shed value.

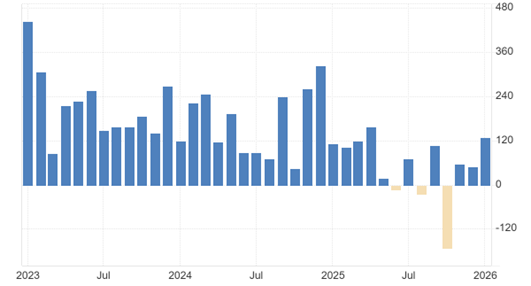

Yes, it’s Wednesday. But yes, we DID get an employment report today. The government shutdown delayed the January report from its traditional Friday morning release…and it was worth waiting for! The economy created 130,000 jobs last month, well above the 70,000 gain that economists expected. The unemployment rate dipped to 4.3%, while average hourly earnings rose 0.4%. Both of those figures came in hotter than anticipated, too.

Nonfarm Payroll Growth (Monthly, Last Three Years)

Source: Trading Economics

The Federal Reserve sat tight with interest rates at its January meeting, keeping the target range for its federal funds rate at 3.5%-3.75%. This reading increases the likelihood the Fed could take another pass at the meeting that concludes March 18.

The “Artificial Intelligence Disruption Trade” swept through another industry yesterday, sending financial stocks broadly lower. Tech startup Altruist Corp. launched an AI-based tool designed to help with financial and tax planning. That caused stocks like Raymond James Financial Inc. (RJF) and Charles Schwab Corp. (SCHW) to plunge on concern it could hurt financial advice-based client activity, revenue, and earnings. SaaS companies previously got pummeled over AI disruption worries.

Finally, the retail brokerage Robinhood Markets Inc. (HOOD) reported fourth-quarter results late yesterday – and investors gave them a big thumbs down. Earnings fell 35% to 66 cents per share, while revenue of $1.28 billion missed the average forecast of $1.36 billion. Transaction revenue was weaker-than-expected across the board (options, cryptocurrency, and stocks). Robinhood stock slid 9% in early trading.