This looks like the week for many of markets to finally reverse, writes Andy Waldock.

This looks like the week for many of the markets we’ve been watching to finally give us the reversal action upon which we trade. We watch and wait while the battle between the commercial traders and the speculators grows. The bigger the imbalance becomes, the more closely we watch for the market’s move to exhaust itself. Finally, once the market cues its reversal, we take action. This is a mean reversion trading strategy that profits on the unwinding of the speculative position as the market returns to its previously traded prices.

This week, both the Japanese yen and Swiss franc fit these criteria. Also noteworthy is the early seasonal commercial trader selling in the platinum market. Platinum miners are beginning to chase the market lower on fears they might not be able to sell more at $900 per ounce.

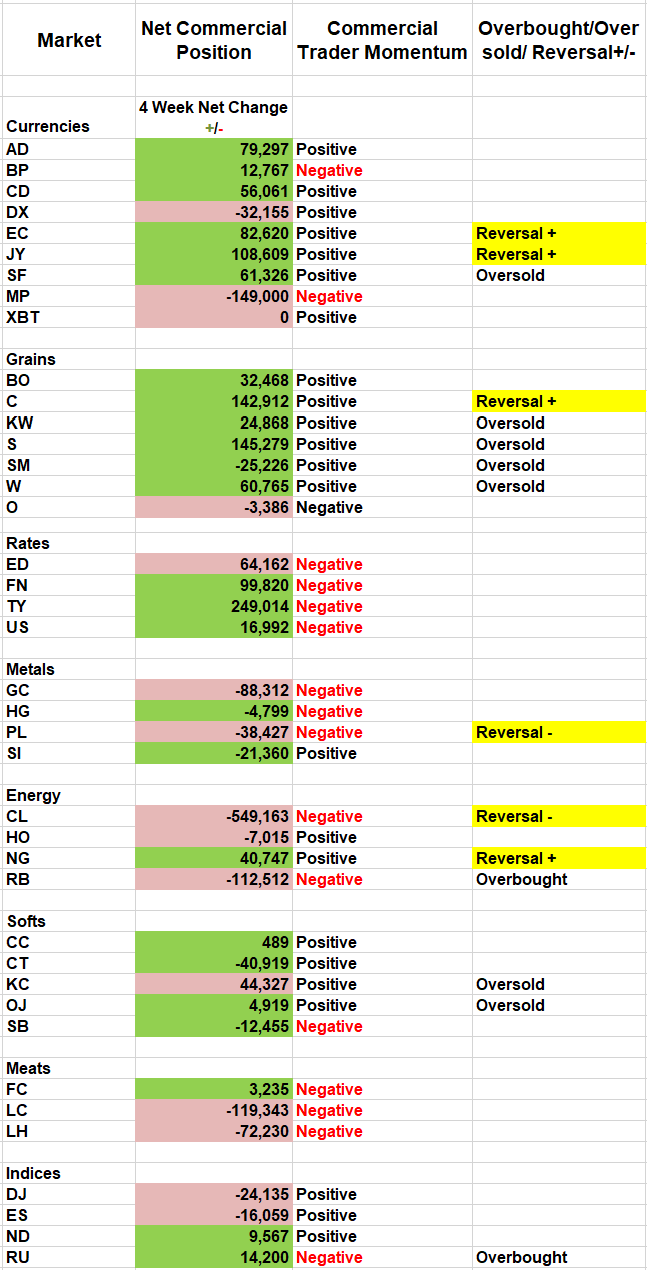

There are six markets we follow that are indicating a reversal pattern— the euro, Japanese yen, corn, platinum, crude oil and natural gas—and several more indicating overbought/oversold conditions (see COT Table).

U.S. Dollar Index

I expect the dollar to continue to decline this week. The dollar could fall 2.00 full handles and still maintain the upward trend line dating back to last September. A close below 95.25 violates this trend and calls into action the long-term moving averages for support around 93.00.

Swiss Franc

The Swiss franc has seen a surge in commercial buying as the market made new lows for the move. They’ve been net buyers in each of the last four weeks and have pushed their current net long position above 61k contracts. This is important because it nearly matches last August’s level of net long 68k contracts. The August net long position has only been exceeded by June of 2007’s record net long position. Furthermore, the total commercial position is nearly 50% larger than the large speculators’ position. This combination of factors makes last week’s new lows look like a short trap in the Swiss.

Corn

This could be a tough week of trading in the grain markets. Flooding along the Mississippi River is at record levels and, the impacts of African swine fever are still being determined. Follow us for an in-depth look at both the hog numbers and the expected demand destruction’s impact on grain prices later this week, ahead of Friday’s U.S. Department of Agriculture Supply and Demand report. This will be crucial in determining allotted acreage for this year’s growing season.

Soybeans

The soybean market is facing the same issues as corn. However, the commercial vs. speculator battle has already eclipsed historical totals. The commercial traders set a new net long record position last week at 145,279 contracts. The upper limit for the commercial position has been between 100k – 120k contracts. This is only the third time that the commercial position has exceeded this level. However, we are NOT recommending this market because more homework and data need crunching. Stay tuned, and we’ll dig deeper.

Japanese yen: The Japanese yen made its low for the week on Monday and gained considerable ground on Friday. Raise the protective sell stop to Monday’s low of .8966. This chops our subscribers’ risk down to $312.50 per contract based on last Sunday night’s opening price. This market should test .9100 this week. Finally, closing higher for the coming week will push the yen above the trend from the November low, empowering a strong case for a double bottom and a technical run higher between .9200 and .9300.

Crude Oil vs. Natural Gas Spread: The short crude oil vs. long natural gas spread we discussed last week has provided confirmation this week via an outright COT, short signal in crude oil, as well as a COT, buy signal in the natural gas market. Rarely does a spread workout this symmetrically but we’ll take it as both markets moved our way.

ETF traders can still execute this trade through the purchase of positively correlated natural gas funds like UNG or DGAZ along with the purchase of inversely correlated crude oil ETFs like SOIL, OILD or, SCO.

This confirms the protective stop placements in each of the individual markets while providing us with a head start over the outright signals firing this week. Update the protective stop loss orders to reflect the weekly stops listed, below.

Please, visit waldocktrading.com for our email advisory letters, brokerage and, account management.