The CFTC’s COT data is lining up a strong spread opportunity in the energy complex, reports Andy Waldock.

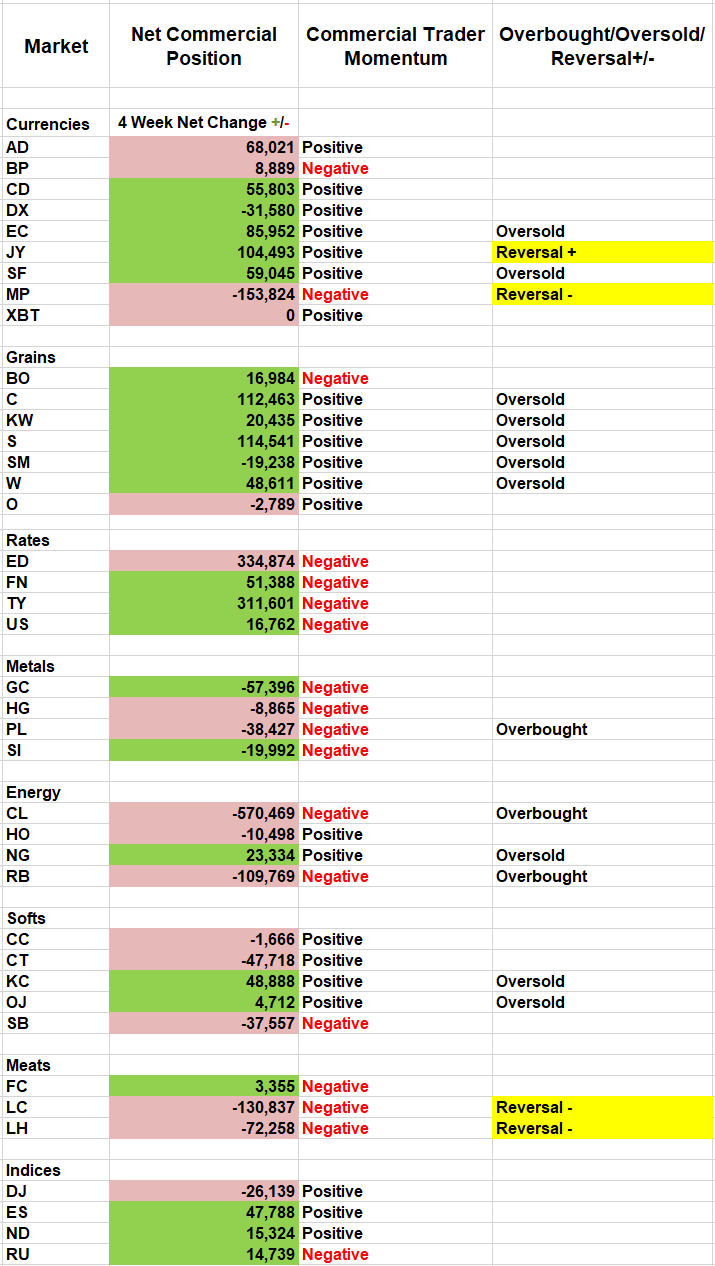

The CFTC’s Commitments of Trader report has indicated negative commercial trader momentum in the crude oil futures contracts along with overbought conditions, and positive commercial momentum with oversold conditions in the natural gas futures contract (see COT Table below). This is lining up for a strong spread strategy in the energy complex.

We’ve been waiting patiently for not only a crude oil short sale signal but, also a natural gas buy signal. Crude oil producers selling forward production are increasing their bets that this is about as high a price as they’ll be able to get into the not so distant future. Meanwhile, natural gas providers have taken advantage of low prices coupled with low volatility to fill their storage tanks for later distribution. These concurrent pressures should begin to weigh on crude and support natural gas, thus creating a spread trading opportunity.

There are multiple ways to view and trade the spread between natural gas and crude oil. We’ll keep it simple. The point of the trade is that we expect the gap between natural gas and crude oil prices to narrow. Therefore, we’re going to buy natural gas and sell crude oil.

Spread trading involves more variables than we usually have to consider. First of all, spread movement can affect your account in multiple ways. We’re now dealing with six variables, rather than a single market’s three. We could close higher lower or, unchanged in either or, both of the markets we’re trading. It’s important to understand that spread trading — even calendar spread trading within the same market — is no less risky than trading the outrights.

Now, since we’re speculators, rather than commercial players, we’ll discuss the spread strategy in terms of dollars and cents, rather than British thermal unit (Btu) equivalencies. The crude oil contract is currently valued at $63,000 per contract while the value of the natural gas contract is approximately $26,000. However, contract value alone is not enough information upon which we can base our decision.

The individual contracts’ daily movement must also be considered. I use the market’s average true range multiplied by the point value to determine the dollar and cents effect each contract may have on my account value. The most important input in our average true range calculation is the number of bars for which we’re collecting data. Even though this is weekly analysis, it’s still swing trading. Therefore, we’ll use the five-bar average true range for both crude oil and natural gas to determine the expected contracts’ movement (most charting platforms default to 14 bars). Crude oil has a $2.98 average true range for the five weeks or, $2,980. Natural gas has a five-bar average true range of .1242 or, $1,242.

Using these calculations, we’re suggesting a purchase of three natural gas contracts and a short sale of one crude oil contract. These should be executed for the July expiration. Ideally, the turn has been made for each of these contracts. As prudence is always the better part of valor in trading, watch either contract for penetration of their recent swing highs, $66.44 in July crude oil and $2.534 in July natural gas. This is just over $3,000 in risk per position in crude and just under $3k for the three natural gas contracts per position.

Meats: Both the cattle and hog trades have worked out wonderfully. We’ve got more than $3,200 in the hog trade and approximately the same in the cattle trade. Neither of these windfalls should be given back to the market. Technically, hogs put in an outside bar with a close below Thursday’s low. This is extremely bearish (and corresponds with a bearish QuantCycles Oscillator). The protective hog stop should be lowered to Friday’s high of 91.425. My initial target on the daily charts is around $86. Look for a $111.50 target in the June cattle, and don’t risk it above $116.

We offer more specific instructions in our Weekly COT newsletter.

Andy described how traders can exploit the Commitments of Traders report in an interview with Dan Collins at the TradersEXPO New York: Understanding the COT Report.