US-China Trade issues may focus on chip makers, says Joe Duarte. He lists a few to watch.

We can talk ourselves into just about anything these days, but Wall Street got a post Labor-Day jolt as the geopolitical situation eased some regarding Hong Kong and Brexit while the U.S.-China trade talks shifted away from sanctions with a bilateral promise of October talks. The upshot was a huge two-day rally in technology stocks coupled with a major selloff in the bond market and bond proxies such as REITS, homebuilders, and dividend stocks. By Friday, however, after the muted U.S. payroll number, traders paused, and by the weekend, Hong Kong and Brexit were heating up again, so by the middle of the week, things may be up in the air again.

Nevertheless, as I noted over the last two weeks, the stock market was due for a surprise move of some sort although the direction was unknown. Certainly the action on Sept. 4 and Sept. 5 qualifies for, at least the early part of that move being to the upside as the bears, overwhelmed by algo fueled program buying in the futures market had to scramble and cover their shorts. The big questions now are whether this rally has any staying power and whether, or more likely how much the Federal Reserve decides to lower interest rates at its upcoming FOMC meeting— even in the face of the stock market being within reach of its all-time highs.

Realistically speaking, however, investors are caught between a market where momentum may have returned, at least in the short to intermediate term, and the reality that neither the United States nor China seem to be willing to give in to the other’s demands on trade or anything else. So, what it all boils down to is that unless there is something much bigger unfolding under the surface the odds of yet another disappointment is high.

Still it is possible that we may be seeing the early innings of a sector rotation away from the defensive stocks and into aggressive growth stocks.

It’s Still about Bonds, the Fed, and MEL

Stock investors certainly got some good price moves despite, or perhaps because of mixed U.S. economic data (PMI manufacturing and services) but the Fed and the bond market are still in charge. So before making big portfolio moves it’s important to consider what the effect of the somewhat stabilizing but not highly encouraging global economic data will be on the Fed’s next move and how the bond market responds. Moreover, it’s all about how the whole thing is perceived by investors, how it is reported by the media and how it affects the Markets-Economy-Life system (MEL) as investors and consumers process the data and make decisions about whether to spend their money or to keep their hands in their pockets.

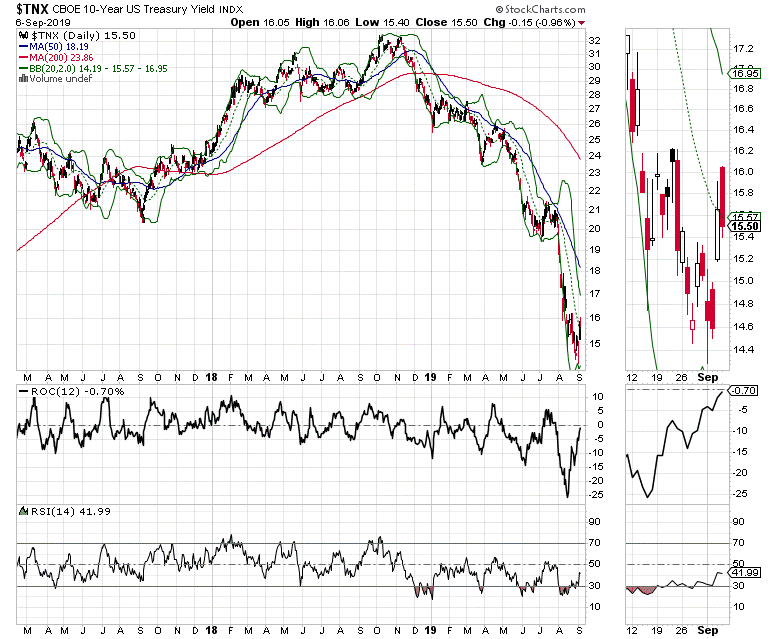

Unfortunately, housing has remained very subdued despite the record low yield on the U.S. 10-year Treasury notes (TNX), the benchmark for 15- and 30-year mortgages. Thus, if there is a big backup in yields it’s not likely that this sector will improve soon, and that could be a further drag on the manufacturing economy.

Perhaps the most interesting event in the markets last week was the rebound of German bond yields above 0.00% for the first time in months, although the bond selloff didn’t last and by the end of the week yields were again falling. Nevertheless, wouldn’t it be something to see if the Fed lowers interest rates and the bond market sells off in a big way leading to higher market yields, which would negate the effects of the central bank rate cuts?

Chip Stocks Regain their Mojo

Long a casualty of the U.S.-China trade war, the semiconductor stocks were languishing until the news of the renewal of trade talks hit the wires and the sector got a bid. Moreover, regardless of where we are in the cycle for the financial markets, one thing is crystal clear; the stock market is in love with the idea that 5G is the next big money maker. In fact, traders seem to dig the concept so much that any news that suggests that somehow Huawei and the U.S. chip makers will be back in business soon sends tech stocks rapidly higher.

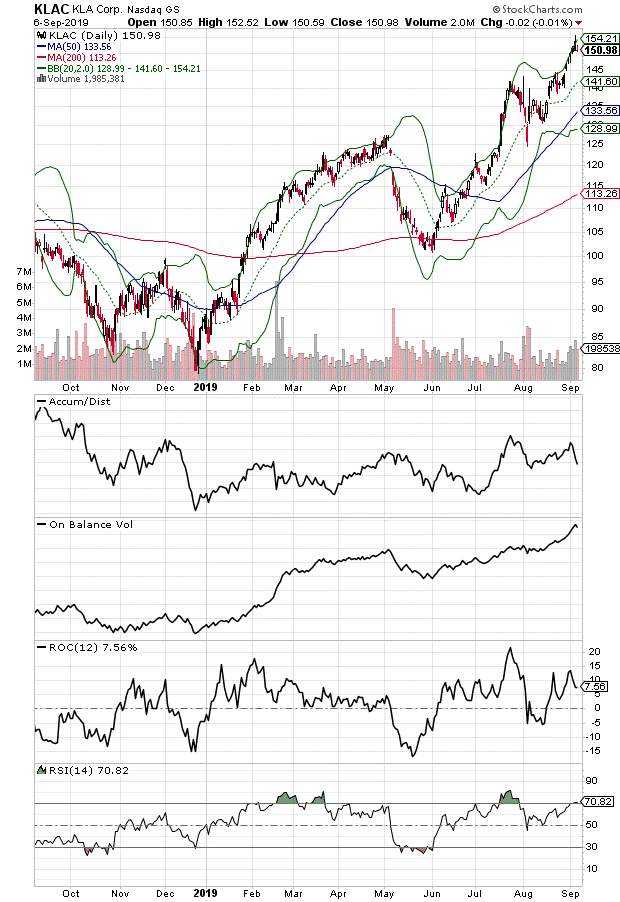

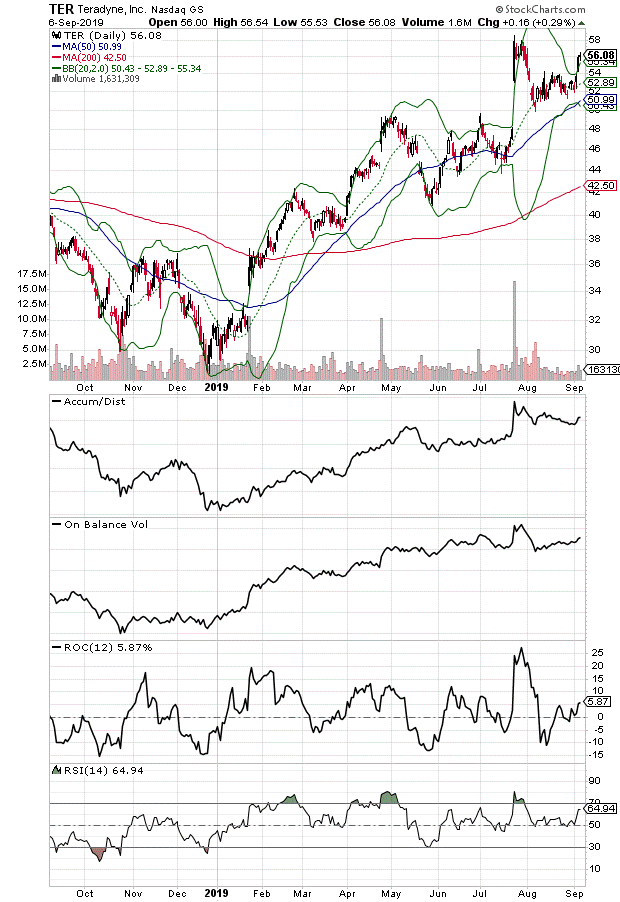

As a result, two chip stocks gathered momentum last week, foundry giant KLA Corp. (KLAC) and Teradyne (TER) a leader in semiconductor testing equipment. Certainly, both KLAC and Teradyne produce and manage electronic components and processes which should profit nicely from the deployment of 5G technology over the next few years, if and when that comes to pass and to a certain degree whether Huawei is involved or not. But algo sub routines, the what to do if this happens parts of trading programs, are not known for their sophistication, given their only two programming choices, 0 and 1. So anything that sounds as if Huawei is out of the dog house sends tech stocks higher.

KLAC’s forte is providing equipment for quality controls, including data analytics and inspection products to reduce errors in the chip manufacturing process while also producing display related products and water processing solutions, printed circuit boards and related products, which gives the company a well-diversified product portfolio well suited to any upturn in the semiconductor cycle.

Teradyne shares, for their own have been consolidating after a very upbeat earnings report released in July. And although the stock got ahead of itself after the good news, shares look ready to resume their uptrend barring the usual external event risk related to the U.S.-China trade war if they can clear the current resistance near the $56-$58 area (see chart).

Both KLAC and TER are banking on increased revenues and earnings related to the expected 5G rollout over the next few years, which means that if and when that dynamic really rolls, these stocks should respond positively.

Indeed, what brings the two together is the global 5G rollout, which of course, in the short term is highly dependent on the U.S.-China trade war. And while Nokia (NOK) and Ericsson (ERIC) are Huawei’s competitors in 5G, they don’t have the scale to compete in a major way. As a result, any developments about 5G will require an answer to what the U.S. and to some degree the rest of the world decide with regard to Huawei.

In other words, if and when the U.S. and China agree on their trade issues, the next big shoe to drop is to what degree the alleged spying issues involving Huawei are settled and whether Teradyne and KLAC can resume their rapid pace of sales to them over the next few years. Otherwise, much depends on how much of Huawei’s market share can be picked up by Nokia, Ericsson and any new players that decide to jump into the field and what type of sales they can generate from companies such as KLAC and TER. Accordingly, the fact that both NOK and ERIC are essentially in the penny stock price range these days suggests that the market is making a big bet on Huawei coming out a winner in October.

I recommended both KLAC and TER in the late August-September timeframe, and suggest opening small positions with sell stops to guard against trade war related volatility.

Market Breadth Regains Strength

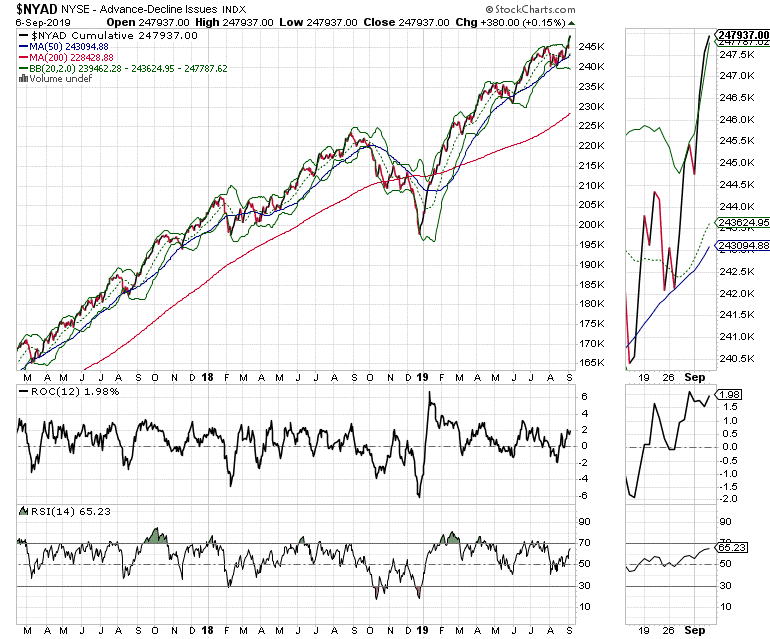

The bright spot in the stock market is the New York Stock Exchange Advance-Decline line (NYAD), the most accurate indicator of the general market trend since the 2016 presidential election, which soared to several new highs on the U.S.-China trade news.

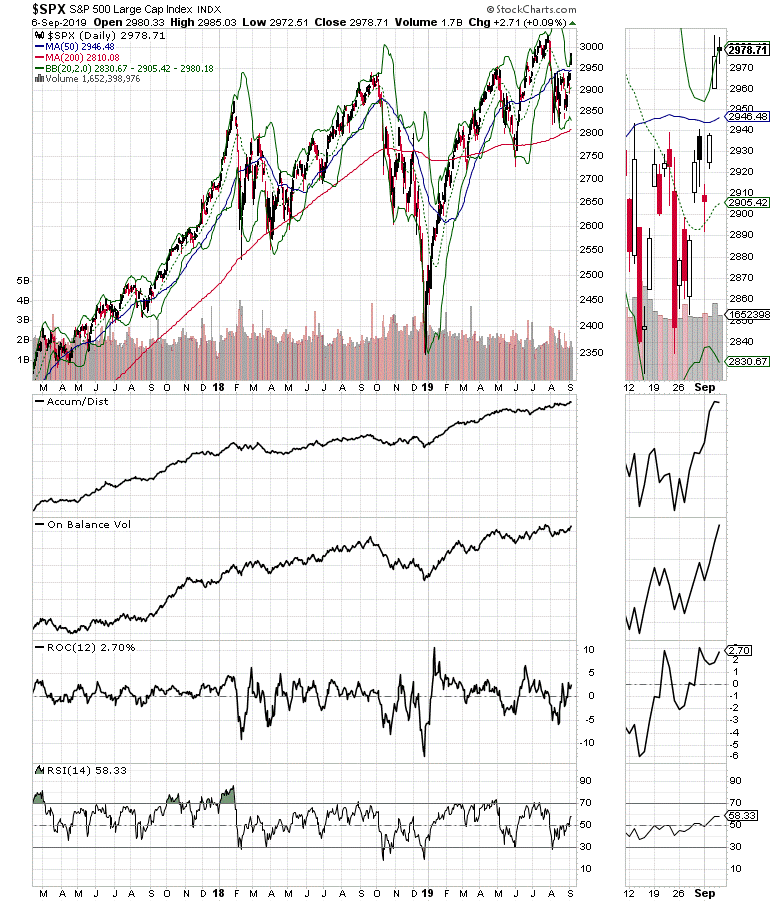

Moreover, the Nasdaq 100 (NDX) and the S&P 500 (SPX) indexes both rallied above their 50-day moving averages. Certainly, neither index is too far from breaking out to new highs, which means that if there is a breakout, money will likely flow in and extend the rally. However, if the rally fails the likelihood of a rapid return to selling is high.

However, Accumulation Distribution (ADI) and On Balance Volume (OBV) for NDX rolled over by the end of the week while holding up better on SPX, which suggests that tech traders are still cautious.

Avoid the Kool-Aid

It’s hard to know if the U.S.-China talks in October will be meaningful or not. It’s even harder to fathom what will happen between the U.S. government and Huawei, as the former has alleged that the latter embeds spyware into the chips its sells and hints at national security repercussions from the practice.

What we do now is that stocks were poised for a big move and that the action on Sept.4-5 suggests that the move has started and that its direction is to the up side, barring a litany of things that could go wrong. In the end all we can do is trade accordingly without drinking totally bullish or insanely bearish Kool-Aid.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.