Short position in QQQ would profit from continued weakness in Apple, reports Jay Soloff.

Can you name the biggest stocks in the U.S. markets? It probably won’t take you long to pick out the highest market cap companies, with well-known names like Apple (AAPL), Amazon (AMZN) and Microsoft (MSFT).

What’s interesting is that the five largest U.S. companies, and several others near the top, are all primarily tech companies. They are also all listed on the Nasdaq exchange. It used to be the New York Stock Exchange held all the biggest names, but that’s no longer the case.

In fact, if you are looking to focus on mega-cap stocks in your portfolio, you are probably better off buying the Nasdaq 100 Index or its ETF, Invesco QQQ Trust (QQQ) rather than the Dow Jones Industrial Average index. The Dow 30 is actually missing several of the top stocks from the QQQ component list.

Like the Dow, QQQ can be impacted greatly by big swings from its largest holdings. The top five most heavily weighted stocks make up more than 40% of the index, with AAPL topping the list at over 11%.

So, when Apple recently announced that it would be cutting revenue guidance due to the impact of the Coronavirus, you could anticipate selling pressure on the QQQ as well. However, with AAPL down 2% on the day after the announcement, QQQ was actually flat on the day.

Nevertheless, larger moves sometimes take a while to develop. Apple’s announcement could be the tip of the iceberg in regard to negative revenue effects from the virus. We may yet see several more downward revisions in the days to come.

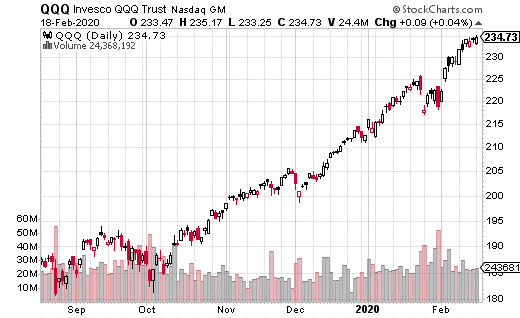

Delving deeper, the options market also points to a potential pullback in QQQ (see chart).

As you can see, QQQ has been on a tear for the last several months. However, a large put spread in March options could be a sign that the ETF isn’t going to remain quite so elevated over the next month.

With QQQ at $234, a trader purchased 2,400 March 20 230-222 put spreads for $1.52. The 230 puts were purchased while the 222 puts were sold to reduce the cost of the trade. The most that can be lost on the trade is the premium paid, or $1.52. Meanwhile, $6.48 is the max gain if QQQ drops below $222 by expiration.

There's a potential 426% gain if the Nasdaq 100 falls off a cliff. But for that to happen, the index would need to drop from $234 down to $222, roughly a 5% selloff in the next month. The breakeven point is at $228.48, which is about a 2.5% drop.

A trade like this is generally used as a hedge against a portfolio of stocks. In this case, that portfolio would be tech-heavy. On the other hand, it could also be a straightforward bearish bet on the Nasdaq 100, possibly due to the market being spooked by the AAPL news. This trade would also be relatively easy to replicate in your own portfolio.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Profit Engine, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.