I’m excited about the potential of OneStream Inc. (OS), a little-known, mid-cap financial software company that just came public in July. The pitch is that management thinks their software platform will become the operating system for modern finance, finally freeing CFOs and finance departments from the shackles of old, outdated, on-prem financial software, advises Tyler Laundon, editor of Cabot Early Opportunities.

All the other departments are using cool, modern, cloud-based software. Why shouldn’t finance? The department has been living in the dark ages. The main issues to adoption have been concerns about security and data integrity. Valid. But only up to a point.

Today’s cloud computing environment is up to these challenges far more than it was even just a few years ago. OneStream’s software, which features embedded AI and ML for enterprises, helps CFOs with planning, forecasting, employee performance, decision making, analytics, and more.

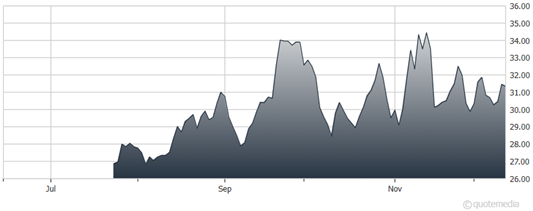

OneStream Inc. (OS)

Roughly 11% of revenue comes from on-prem software licenses (sold mostly to government entities). The remaining 81% comes from cloud software sold under the typical subscription model. Professional services make up the balance.

The company grew revenue by 31% over the first three quarters of 2024 and should deliver about $485 million for the full year. Adjusted EPS should be around $0.05. Looking into 2025, consensus currently calls for 21% revenue growth, to $584 million, and 168% EPS growth, to $0.12.

I suspect actual results will be better than expected when all is said and done. Lockup expiration just passed in November so new investors can begin to build positions with the understanding that insiders aren’t being forced to hold their shares, even if they wish to diversify.