Business capex grew at a respectable 3.2% year-over-year in the second quarter even as payroll growth slowed substantially. Historically, the decision to hire and invest has been intertwined at a correlation of 74% (since 2000). Enter AI, says Nancy Tengler, CIO at Laffer Tengler Investments.

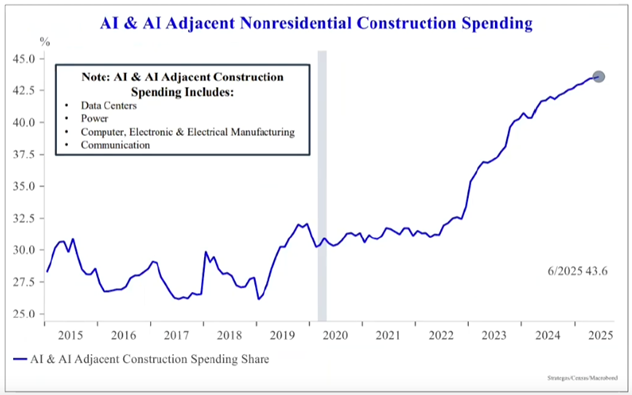

Mag 7 capex is estimated to be $318 billion in Q2. That is a trailing four quarter sum. This represents 24% of S&P 500 capex, but is modest when compared to total US nominal business capex of approximately $4.1 trillion. AI and AI-adjacent investment is 44% of business construction spending and 34% of total.

(Editor’s Note: Nancy Tengler is speaking at the 2025 MoneyShow Masters Symposium Sarasota, scheduled for Dec. 1-3. Click HERE to register.)

Though many are equating AI spending to the Dot-Com Bubble, we think the party is just getting started. We are using volatility as our friend and adding to the drivers/infrastructure names on weakness.

Remember John Chambers' comment recently that AI is a more powerful productivity driver than “the Internet and cloud computing combined.” Chambers was the CEO of Cisco Systems Inc. (CSCO) in 2000 — the poster child of overvaluation since it traded at 100x peak earnings before the bust.

What do we worry about? The US government meddling in the private sector, export taxes, stakes in companies - all a dangerous precedent in our view. Let the markets pick winners and losers. Solyndra may be a distant memory, but an important one to keep front and center.