Becton, Dickinson & Co. (BDX) is a global medical technology company that develops, manufactures, and sells a wide range of medical supplies, devices, laboratory equipment, and diagnostic products. It represents an attractive total return opportunity for 2026, suggests Kelley Wright, editor of IQ Trends.

BDX operates through five segments: Medical Essentials, Connected Care, BioPharma Systems, Interventional, and Life Sciences. BDX's product offerings include peripheral intravenous catheters, medication delivery and management systems, pre-fillable drug delivery systems, and advanced patient monitoring systems.

The company provides solutions for healthcare institutions, life science researchers, clinical laboratories, and the pharmaceutical industry on a global scale. The company's operations extend across multiple geographies, including manufacturing facilities in the US, China, and Germany, among others.

Becton Dickinson & Co. (BDX)

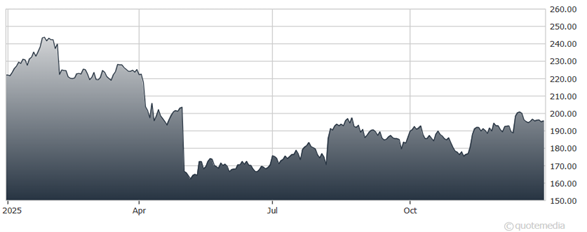

The historically repetitive high dividend (Undervalue) yield is 1.6%. Based on the current dividend of $4.20, that equates to a $255 share price. Recently trading around $192 per share, the current yield was about 2.1%. That represents a 33% discount from its historically repetitive Undervalue area.

The historically repetitive low dividend (Overvalue) yield is 1.1%. Again, based on the current dividend of $4.20, that equates to $355 per share, which represents a theoretical 90% upside.

The ROIC (return on invested capital) is 10%. The FCFY (free cash flow yield) is 4%, and the P/EBV (price dividend by economic book value) is 0.9. Economic Earnings Per Share = $6.45 vs $5.81 reported (GAAP). The Economic Book Value = $217.66 per share.

My thought is the negatives expressed by the analytical community have been fully baked into the current stock price, but the internal cash flow measures paint a more positive picture.

Recommended Action: Buy BDX.