While most of the world has been fixated on a handful of overpriced, overhyped tech stocks, Safe Money Report readers have been doing very well with economically insensitive stocks that pay big dividends. When I performed a screen using the Weiss Ratings system looking for highly rated consumer staples companies, Cal-Maine Foods Inc. (CALM) jumped out at me right away, observes Nilus Mattive, editor of Safe Money Report.

I don’t see any reason for things to change going forward, especially if the companies I target can keep hiking their prices at — or above — general inflation rates. With CALM, it’s categorized as a packaged foods company, but eggs are its specialty.

I probably don’t need to tell you that eggs became the universal symbol of rising prices when inflation was really soaring…or that people still kept on buying them despite all the complaining. That’s precisely why I’ve been recommending the company as a solid holding going forward.

Cal-Maine is actually the largest publicly traded egg producer in the US, with 48 million egg-laying hens and annual egg sales of roughly 1.3 billion. The company’s revenue soared along with egg prices. And even though one of the big driving forces — an outbreak of the H5N1 avian flu — has started to fade, prices are still in line with levels from two years ago.

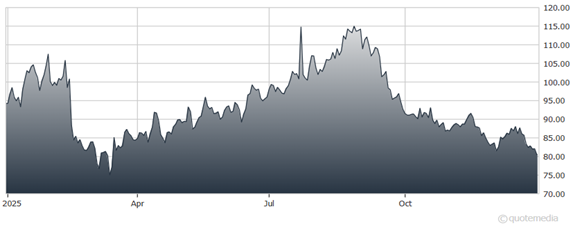

Cal-Maine Foods Inc. (CALM)

Cal-Maine also has an extra advantage: Its leading position in free-range and organic egg categories. That gives it a great segment of the market where well-heeled customers are usually willing to pay even higher-than-average prices.

All that said, Cal-Maine’s future earnings and profits are relatively hard to predict. A lot will depend on where egg prices go. And investors were actually pushing the stock even lower into the end of 2025. But at less than four times the company’s earnings over the last twelve months, profits could get cut in half and the shares would still be trading at a very reasonable single-digit P/E!

Meanwhile, the company adjusts its dividends every quarter so that they equal one-third of quarterly income. I expect they will at least match — and probably exceed — what US Treasurys will produce over the next year or two. And unlike a bond’s yield, CALM’s yield can keep on climbing the longer you hold.

Given its reasonable valuation, solid business, and ongoing dividends, I think this is a great conservative play for 2026 and beyond. And the Weiss Ratings system agrees, giving CALM a solid B- “Buy” rating recently.

Recommended Action: Buy CALM.