Cardinal Health Inc. (CAH) is a healthcare services and products company in the US and internationally. The company operates two divisions, namely Pharmaceutical and Specialty Solutions and Global Medical Products and Distribution, writes Louis Navellier, founder and chairman of Navellier & Associates.

Its Pharmaceutical and Specialty Solutions division provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home. This division distributes branded and generic pharmaceutical, specialty pharmaceutical, and over-the-counter healthcare and consumer products.

The company’s Global Medical Products and Distribution division (1) provides services to pharmaceutical manufacturers and healthcare providers for specialty pharmaceutical products; pharmacy management services to hospitals; (2) operates pharmacies, including pharmacies in community health centers; and (3) repackages generic pharmaceuticals and over-the-counter healthcare products.

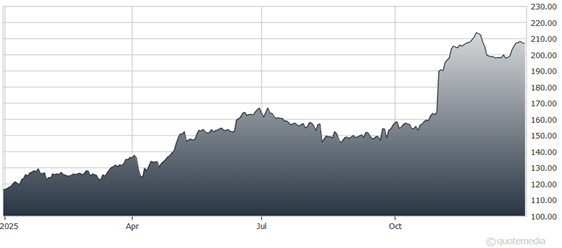

Cardinal Health Inc. (CAH)

In its latest quarter, Cardinal Health’s revenue rose by 22.4% to $64 billion from $52.3 billion in the same quarter a year ago. During the same period, the company’s operating earnings rose by 35.6% to $611 million, or $2.55 per share, from $460 million, or $1.88 per share.

The analyst community was expecting revenue of $58.6 billion and operating earnings of $2.21 per share. So, Cardinal Health posted an 8.4% revenue surprise and a 15.4% earnings surprise.

In the past three months, the analyst community has revised their consensus earnings estimate up 4.3%. Typically, positive analyst earnings estimates precede future earnings surprises. The stock is a good buy.

Recommended Action: Buy CAH.